This condition is stipulated in Chapter 3: Loss of South African Citizenship, Section 6(1) of the South African Citizenship Act of 1995. It does not include someone who gains foreign citizenship through marriage, and the section also does not apply to children minors.

Relinquishing your status as a citizen does not have any tax benefits for those seeking to cease their tax residency. Also, you will be alienated from certain rights you may consider your heritage and not worth sacrificing.

So, when developing your roadmap towards full financial emigration, whether this is just financially moving your money or also the physical move of a family, it is critical that you consider deeply what South African citizenship means to you. You must also be well informed of the options available to you, as these decisions impact the rest of your life as well as generations to come.

Residence vs citizenship

Foreign citizenship must not be confused with permanent residence abroad.

Many South Africans emigrate under a host country’s permanent residence programme, requiring them to hold an appropriate visa throughout. They cannot apply for that jurisdiction’s passport, and may typically be excluded from rights reserved for full citizens, like voting. Just moving to another country does not result in the loss of your South African citizenship. A good example is Mauritius, where a retirement visa can be relatively easily obtained and with no property investment. However, this does not qualify you to eventually take up Mauritius citizenship.

Where you formally accept citizenship in another country, you can be issued with its passport and enjoy all the benefits of being a citizen. But you will relinquish your South African citizenship by that act alone. Although the Act provides for the resumption of your citizenship, this is not possible as long as you remain a foreign national.

Yet, there is a way to avoid this situation, but you must act quickly.

Dual citizenship

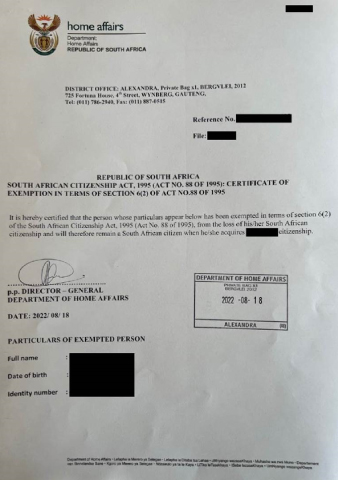

Section 6(2) of the Citizenship Act allows you to apply to the Minister of Home Affairs to retain your South African citizenship. This is provided you do so prior to losing it for accepting foreign citizenship. Because once it is lost, it is lost for good or a process which no-one will voluntarily undertake.

If the Minister deems it fit, they will order the retention of your citizenship, as shown in the example certificate of exemption below.

Making this application a priority will allow you to enjoy the best of both nationalities.

Tax residency

It may be tempting to suppose that relinquishing your citizenship is sufficient grounds to cease tax residency in South Africa. Or that becoming a foreign national absolves one of any outstanding tax or legal obligations.

This is not true and not worth sacrificing your citizenship for.

Section 12 of the Act provides that a person is not freed “from any obligation, duty or liability in respect of any act done or committed before he or she ceased to be a South African citizen”.

This includes your tax obligations to SARS, which remain even after you become a foreign citizen, until they are settled.

Planning ahead

There are significant benefits to having a second passport, often referred to as a “Plan B”, for those not physically leaving South Africa; but just keeping their wealth outside South Africa or being on a roadmap to migrate their family internationally. The costs involved depends very much on your goals with another passport and which country’s status you want to access.

As a practice which specialises in international employees, business owners with international interests and high net worth families, we see a second passport strategy as an important part of the roadmap. Also, we often assist South African’s who emigrate to keep their South African passport, as one never knows what the future holds and there is no tax benefit in giving up your South African citizenship.

![2025-logo-[Recovered] Tax Consulting South Africa](https://www.taxconsulting.co.za/wp-content/uploads/2025/01/2025-logo-Recovered.png)