TABLE OF CONTENTS

BUDGET HIGHLIGHTS

TAX REVENUE 2019/2020

INDIVIDUAL TAX

TAX RATES AND REBATES

Individuals, Estates & Special Trusts

Year ending 28 February 2021

| Taxable Income | Rate of tax (R) |

|---|---|

| R0 – R205 900 | 18% of taxable income |

| R205 901 – R321 600 | R37 062 + 26% of taxable income above R205 900 |

| R321 601 – R445 100 | R67 144 + 31% of taxable income above R321 600 |

| R445 101 – R584 200 | R105 429 + 36% of taxable income above R445 100 |

| R584 201 – R744 800 | R155 505 + 39% of taxable income above R584 200 |

| R744 801 – R1 577 300 | R218 139 + 41% of taxable income above R744 800 |

| R1 577 301 and above | R559 464 + 45% of taxable income above R1 577 300 |

Year ending 29 February 2020

| Taxable Income | Rate of tax (R) |

|---|---|

| R0 – R195 850 | 18% of taxable income |

| R195 851 – R305 850 | R35 253 + 26% of taxable income above R195 850 |

| R305 851 – R423 300 | R63 853 + 31% of taxable income above R305 850 |

| R423 301 – R555 600 | R100 263 + 36% of taxable income above R423 300 |

| R555 601 – R708 310 | R147 891 + 39% of taxable income above R555 600 |

| R708 311 – R1 500 000 | R207 448 + 41% of taxable income above R708 310 |

| R1 500 000 and above | R532 041 + 45% of taxable income above R1 500 000 |

| Rebates | 2020/2021 | 2019/2020 |

|---|---|---|

| Primary | R14 958 | R14 220 |

| Secondary (Persons 65 and older) | R8 199 | R7 794 |

| Tertiary (Persons 75 and older) | R2 736 | R2 601 |

| Age | Tax threshold | |

| Below age 65 | R83 100 | R79 000 |

| Age 65 to below 75 | R128 650 | R122 300 |

| Age 75 and older | R143 850 | R136 750 |

MEDICAL TAX CREDIT RATES

| Per month (R) | 2020/2021 | 2019/2020 |

|---|---|---|

| For the taxpayer who paid the medical scheme contributions | R319 | R310 |

| For the first dependant | R319 | R310 |

| For each additional dependant(s) | R215 | R209 |

TAKE-HOME PAY

The table below sets out a comparison of the take-home pay that an individual can expect based on the 2020 and 2021 tax tables:

| Take-home pay | |||||||

|---|---|---|---|---|---|---|---|

| 2020/2021 | 2020/2021 | 2020/2021 | 2019/2020 | 2019/2020 | 2019/2020 | ||

| Monthly gross | Annual equivalent | Under 65 | 65 – 74 | Over 75 | Under 65 | 65 – 74 | Over 75 |

| R6 583,33 | R79 000,00 | R6 583,33 | R6 583,33 | R6 583,33 | R6 583,33 | R6 583,33 | R6 583,33 |

| R6 925,00 | R83 100,00 | R6 925,00 | R6 925,00 | R6 925,00 | R6 863,50 | R6 925,00 | R6 925,00 |

| R10 000,00 | R120 000,00 | R9 446,50 | R10 000,00 | R10 000,00 | R9 385,00 | R10 000,00 | R10 000,00 |

| R15 000,00 | R180 000,00 | R13 546,50 | R14 229,75 | R14 457,75 | R13 485,00 | R14 134,50 | R14 351,25 |

| R20 000,00 | R240 000,00 | R17 419,17 | R18 102,42 | R18 330,42 | R17 290,67 | R17 940,17 | R18 156,92 |

| R30 000,00 | R360 000,00 | R24 659,17 | R25 342,42 | R25 570,42 | R24 465,04 | R25 114,54 | R25 331,29 |

| R40 000,00 | R480 000,00 | R31 413,75 | R32 097,00 | R32 325,00 | R31 128,75 | R31 778,25 | R31 995,00 |

| R50 000,00 | R600 000,00 | R37 774,25 | R38 457,50 | R38 685,50 | R37 417,75 | R38 067,25 | R38 284,00 |

| R80 000,00 | R960 000,00 | R55 715,58 | R56 398,83 | R56 626,83 | R55 298,26 | R55 947,76 | R56 164,51 |

| R110 000,00 | R1 320 000,00 | R73 415,58 | R74 098,83 | R74 326,83 | R72 998,26 | R73 647,76 | R73 864,51 |

| R130 000,00 | R1 560 000,00 | R85 215,58 | R85 898,83 | R86 126,83 | R84 598,25 | R85 247,75 | R85 464,50 |

The table below sets out a comparison of the PAYE that would have been/will be deducted from an individual’s salary in 2020 and 2021:

| Take-home pay | |||||||

|---|---|---|---|---|---|---|---|

| 2020/2021 | 2020/2021 | 2020/2021 | 2019/2020 | 2019/2020 | 2019/2020 | ||

| Monthly gross | Annual equivalent | Under 65 | 65 – 74 | Over 75 | Under 65 | 65 – 74 | Over 75 |

| R6 583,33 | R79 000,00 | – | – | – | – | – | – |

| R6 925,00 | R83 100,00 | – | – | – | R61,50 | – | – |

| R10 000,00 | R120 000,00 | R553,50 | – | – | R615,00 | – | – |

| R15 000,00 | R180 000,00 | R1 453,50 | R770,25 | R542,25 | R1 515,00 | R865,50 | R648,75 |

| R20 000,00 | R240 000,00 | R2 580,83 | R1 897,58 | R1 669,58 | R2 709,33 | R2 059,83 | R1 843,08 |

| R30 000,00 | R360 000,00 | R5 340,83 | R4 657,58 | R4 429,58 | R5 534,96 | R4 885,46 | R4 668,71 |

| R40 000,00 | R480 000,00 | R8 586,25 | R7 903,00 | R7 675,00 | R8 871,25 | R8 221,75 | R8 005,00 |

| R50 000,00 | R600 000,00 | R12 225,75 | R11 542,50 | R11 314,50 | R12 582,25 | R11 932,75 | R11 716,00 |

| R80 000,00 | R960 000,00 | R24 284,42 | R23 601,17 | R23 373,17 | R24 701,74 | R24 052,24 | R23 835,49 |

| R110 000,00 | R1 320 000,00 | R36 584,42 | R35 901,17 | R35 673,17 | R37 001,74 | R36 352,24 | R36 135,49 |

| R130 000,00 | R1 560 000,00 | R44 784,42 | R44 101,17 | R43 873,17 | R45 401,75 | R44 752,25 | R44 535,50 |

INTEREST EXEMPTION

| South African Sourced Interest | |

|---|---|

| Persons under 65 years | R23 800 |

| Persons 65 years and older | R34 500 |

South African sourced interest income earned by non-residents is exempt if the non-resident was absent from the country for an aggregate of 183 days in the 12 months preceding the accrual of that interest.

TAX-FREE INVESTMENTS

Amounts received by or accrued to an individual in respect of particular prescribed investment instruments and policies are exempt. Contributions to these prescribed investments/policies are subject to an annual limit of R36 000 (2020: R33 000). Currently, a R500 000 lifetime limit applies.

DIVIDENDS

Dividends received by individuals from South African companies are generally exempt from income tax, but dividends tax at a rate of 20% is withheld by the entities paying the dividends to the individuals.

FOREIGN DIVIDENDS

Most foreign dividends received by individuals from foreign companies (shareholding of less than 10% in the foreign company) are allowed an exemption equal to 25/45 of the gross dividends received. No deductions are allowed for expenditure incurred to produce foreign dividends.

Foreign withholding taxes are allowed as a credit against taxes payable based on taxable foreign income as a percentage of total taxable income.

FOREIGN INTEREST

Foreign interest received by or accrued to a resident is subject to normal tax in South Africa.

TRAVEL EXPENSES

Rates per kilometre, which may be used in determining the allowable deduction for business travel against an allowance or advance where actual costs are not claimed, are determined by using the following table:

| Value of the vehicle (including VAT) (R) | Fixed cost (R p.a. ) | Fuel cost (c/km) | Maintenance cost (c/km) |

|---|---|---|---|

| R0 – R95 000 | R31 332 | 105.8 | 37.4 |

| R95 001 – R190 000 | R55 894 | 118.1 | 46.8 |

| R190 001 – R285 000 | R80 539 | 128.3 | 51.6 |

| R285 001 – R380 000 | R102 211 | 138.0 | 56.4 |

| R380 001 – R475 000 | R123 955 | 147.7 | 66.2 |

| R475 001 – R570 000 | R146 753 | 169.6 | 77.8 |

| R570 001 – R665 000 | R169 552 | 175.1 | 96.6 |

| Exceeding R665 000 | R169 552 | 175.1 | 96.6 |

- If the travel allowance is applicable to a portion of the tax year, the fixed cost is reduced proportionately.

- Where the travel allowance is based on actual distance travelled by the employee for business purposes, no tax is payable on an allowance paid by an employer to an employee, up to the rate of 398 cents per kilometre regardless of the value of the vehicle or distance travelled. This alternative is not available if other compensation in the form of an allowance or reimbursement (other than for parking or toll fees) is received from the employer in respect of the vehicle.

- It is compulsory to keep a logbook of travels in order to claim business travel expenses.

- When claiming actual expenditure, the cost of the vehicle must be limited to R665 000 (2020: R595 000) for the purposes of calculating finance charges and wear and tear.

SUBSISTENCE ALLOWANCE

Where the recipient is obliged to spend at least one night away from his or her usual place of residence on business and the accommodation to which that allowance or advance relates is in the Republic of South Africa and the allowance or advance is granted to pay for:

- meals and incidental costs, an amount of R452 (2020: R435) per day is deemed to have been expended;

- incidental costs only, an amount of R139 (2020: R134) for each day which falls within the period is deemed to have been expended.

Where the accommodation to which that allowance or advance relates is outside the Republic of South Africa, a specific amount per country is deemed to have been expended. Details of these amounts are published on the SARS website under Legal Counsel / Secondary Legislation / Income Tax Notices / 2019.

RETIREMENT FUND CONTRIBUTIONS

Contributions to a pension, provident or retirement annuity fund during a tax year are deductible by the member of the fund. The deduction is limited to the greater of:

- 27.5% of the employee’s remuneration for PAYE purposes (excluding retirement fund lump sums and severance benefits);

or - 27.5% of the employee’s taxable income (excluding retirement fund lump sums and severance benefits).

The deduction is limited to a maximum amount of R 350 000. If contributions exceed the limit during a particular tax year, the contributions are carried over to the next tax year.

DONATIONS

Deductions in respect of donations to certain public benefit organisations are limited to 10% of taxable income (excluding retirement fund lump sums and severance benefits). The amount of donations exceeding 10% of the taxable income is treated as a donation to qualifying public benefit organisations in the following tax year.

Donations tax is levied at a flat rate of 20% on the cumulative value of donations not exceeding R30 million and a rate of 25% on the cumulative value exceeding R30 million. This was effective March 2018. Donations made prior to this date must not be included in the cumulative total.

The first R100 000 of donations in each year by an individual is exempt from donations tax, as well as donations to spouses and certain public benefit organisations.

Donations made by non-residents are also exempt from donations tax.

LUMP SUM BENEFITS

Lump sum benefits in consequence of the withdrawal of membership of a retirement fund, including amounts assigned in terms of divorce settlements in certain circumstances, other than death/retirement lump sum benefits, are taxed according to the following table:

| Taxable income from withdrawal benefits | Tax payable |

|---|---|

| R0 – R25 000 | 0% of taxable income |

| R25 001 – R660 000 | 18% of taxable income above R25 000 |

| R660 001 – R990 000 | R114 300 + 27% of taxable income above R660 000 |

| R990 001 and above | R203 400 + 36% of taxable income above R990 000 |

Lump sum benefits in consequence of retirement/death are taxed according to the following table:

| Taxable income from retirement benefits | Tax payable |

|---|---|

| R0 – R500 000 | 0% of taxable income |

| R500 001 – R700 000 | 18% of taxable income above R500 000 |

| R700 001 – R1 050 000 | R36 000 + 27% of taxable income above R700 000 |

| R1 050 001 and above | R130 500 + 36% of taxable income above R1 050 000 |

- Taxable income is cumulative and includes all lump sum

payments whether on retirement (after 1 October 2007) or

withdrawal (after 1 March 2009), or a severance benefit (after 1

March 2011).

CAPITAL GAINS TAX (CGT)

As from 1 October 2001, Capital Gains Tax (CGT) applies to residents’ worldwide assets and to non-residents’ immovable property or assets of a permanent establishment situated in South Africa.

| Inclusion rates | |

|---|---|

| Individuals, special trusts and individual policyholder funds | 40% |

| Exclusions | |

|---|---|

| Individuals, special trusts and individual policyholder funds | R40 000 |

| Individuals in year of death | R300 000 |

| Primary residence exclusion on the disposal of a primary residence | R2 million gain/loss |

| Small business assets (persons over age 55 and market value of assets not more than R10 million) | R1.8 million |

| CGT example | ||

|---|---|---|

| Salary | R180 000 | |

| Sale of primary residence | ||

| – Proceeds | R4 000 000 | |

| – Agent commission | (R200 000) | |

| – Purchase price | (R1 500 000) | |

| – Improvements | (R150 000) | |

| Sub total | R2 150 000 | |

| Primary residence exclusion | (R2 000 000) | |

| Gain from sale | R150 000 | |

| Sale of shares | ||

| – Proceeds | R50 000 | |

| – Purchase price | (R35 000) | |

| Gain from sale | R15 000 | |

| Total capital gains | R165 000 | |

| Less: Annual exclusion | (R40 000) | |

| Total | R125 000 | |

| Apply inclusion rate (40%) | R50 000 | |

| Total taxable income | R230 000 |

COMMUNAL ESTATE INCOME

Income received by or accrued to a taxpayer, other than that from the carrying on of any trade, but including investment income and capital gain transactions, is deemed to accrue to the spouses, who are married in community of property, in equal portions. This includes income from the letting of fixed property/assets that forms part of the communal estate.

TRUSTS

TRUSTS TAX RATES

| Rate of tax | 2015 | 2016-2017 | 2018-2020 |

|---|---|---|---|

| All taxable income | 40% | 41% | 45% |

Special trusts are taxed at the rates applicable to individuals, but are not entitled to any rebate. The 40% inclusion rate for a taxable capital gain applies to both types of special trusts and 80% inclusion rate for normal trusts.

A special trust is one created:

- solely for the benefit of a person affected by a mental illness or serious physical disability which prevents that person from earning sufficient income to maintain him/herself. Where the person for whose benefit the trust was established dies prior to or on the last day of the year of assessment the trust will no longer be regarded as a special trust;

- as a testamentary trust established solely for the benefit of minor children who are alive and related to the deceased on the date of death. Where the youngest beneficiary turns 18 years of age prior to or on the last day of the year of assessment, the trust will no longer be regarded as a special trust.

SECTION 7C

What is Section 7C?

Section 7C is an anti-avoidance provision designed to prevent avoidance of both donations tax and estate duty through low or no interest loans granted to trusts.

Implications of section 7C?

SARS will deem the interest foregone, on a loan to a trust where the interest is less than the official interest rate, as a donation. This donation is deemed to be made on the last day of the year of assessment of the trust and will be subject to donations tax.

The lender must be either a connected natural person, or a company who granted the loan at the instance of that natural person. This applies to all loan account balances on or after 1 March 2017.

The provision does not apply to loans granted to a trust for the purchase of the lender’s or the spouse’s primary residence.

The official interest rate is linked to the repurchase rate plus 1% and is published on the SARS website. The most recent changes are as follows:

| Date from | Date to | Rate |

|---|---|---|

| 01.04.2016 | 31.07.2017 | 8.00% |

| 01.08.2017 | 31.03.2018 | 7.75% |

| 01.04.2018 | 30.11.2018 | 7.50% |

| 01.12.2018 | 31.07.2019 | 7.75% |

| 01.08.2019 | 31.01.2020 | 7.50% |

| 01.02.2020 | Until change in Repo rate | 7.75% |

Non-Residents:

Loans by non-residents are not subject to the effect of donations tax as a result of S7C since non-residents are exempt from donations tax. Loans from non-residents may nonetheless be subject to transfer pricing provisions.

Distributions to non-residents are fully taxable in the trust at the trust’s applicable tax rate.

COMPANIES

TAX RATES

(Unless otherwise stated, financial years ending on any date between 1 April 2020 and 31 March 2021)

| Basic rate (other than entities specified below) | 28% |

| Companies in certain special economic zones | 15% |

Small Business Corporations (annual turnover of R20 million or less):

Financial years ending on any date between 1 April 2020 and 31 March 2021

| Taxable income | Rate of tax |

|---|---|

| R0 – R83 100 | 0% of taxable income |

| R83 101 – R365 000 | 7% of taxable income above R83 100 |

| R365 001 – R550 000 | R19 733 + 21% of taxable income above R365 000 |

| R550 001 and above | R58 583 + 28% of taxable income above R550 000 |

Financial years ending on any date between 1 April 2019 and 31 March 2020

| Taxable income | Rate of tax |

|---|---|

| R0 – R79 000 | 0% of taxable income |

| R79 001 – R365 000 | 7% of taxable income above R79 000 |

| R365 001 – R550 000 | R20 020 + 21% of taxable income above R365 000 |

| R550 001 and above | R58 870 + 28% of taxable income above R550 000 |

Micro-business (elective presumptive turnover tax for qualifying annual turnover of R1 million or less)*:

Years of assessment commencing on 1 March 2020 or ending on 28 February 2021.

| Taxable turnover | Rate of tax |

|---|---|

| 0 – R335 000 | 0% of taxable turnover |

| R335 001 – R500 000 | 1% of the amount above R335 000 |

| R500 001 – R750 000 | R1 650 + 2% of the amount above R500 000 |

| R750 001 and above | R6 650 + 3% of the amount above R750 000 |

* Qualifying micro-businesses are entitled to pay turnover tax, VAT and employees’ tax twice a year.

DONATIONS

In the case of a taxpayer who is not an individual, exempt donations are limited to casual gifts not exceeding R10 000 per annum in total.

Donations between companies forming part of the same group of companies and donations to certain public benefit organisations are exempt from donations tax.

VAT

The VAT rate remained unchanged at 15%

Compulsory Registration

It is mandatory for a business to register for VAT if the total value of taxable supplies made in any consecutive twelve month period exceeded or is likely to exceed R1 million. The business must complete a VAT 101 – Application for Registration form and submit it to the local SARS branch within 21 days from date of exceeding R1 million.

Voluntary Registration

A business may also choose to register voluntarily for VAT if the value of taxable supplies made or to be made is less than R1 million, but has exceeded R50 000 in the past period of 12 months.

DIVIDENDS

Dividends are subject to dividends tax which is withheld from the gross dividend declared, before being paid to the beneficial owners. The entity declaring the dividend is liable for withholding the tax and paying it to SARS.

The following rates are applicable:

| Beneficial owner | Dividend withholding tax rate |

|---|---|

| Resident individuals | 20% |

| Resident companies | 0% |

| Non-resident individuals and companies | Refer to tax rates per South African DTA Agreements – available on the SARS website |

FRINGE BENEFITS

Right of Use of Motor Vehicle

As from 1 March 2015, for vehicles acquired or financed, the determined value for the fringe benefit is the retail market value (previously cost) including VAT but excluding finance charges and interest. The determined value of a motor vehicle held under a lease is the cash value.

The employee will be taxed on 3,5% (3,25% if subject to a maintenance plan) per month of the determined value of the motor vehicle less any consideration paid by the employee towards the cost of the vehicle.

Medical Aid Contributions

As from 1 March 2010, the full contribution by an employer is a fringe benefit. If the employer makes a lump sum payment for all employees, the fringe benefit is determined in accordance with a formula, which will have the effect of apportionment amongst all employees concerned. The fringe benefit has no value where the contributions are made for an employee who retired due to superannuation or ill health, or for dependants of a deceased employee.

Low Interest or Interest-Free Loans

The fringe benefit is the difference between the interest rate charged by the employer and the official interest rate applied to the loan amount.

The fringe benefit has no value where the loan is less than R3 000 or where a loan is made to an employee to further his/her own studies.

Employers should consider the requirements to register as a credit provider in terms of the National Credit Act when providing interest bearing loans to employees.

Retirement funding contributions

Retirement funding contributions paid by the employer as part of remuneration is included in taxable income as a fringe benefit.

Employer pays for tax and related services

An employee should be taxed on a fringe benefit whenever an employer pays tax and related services rendered to that employee.

Residential Accommodation

The value of the fringe benefit to be taxed is the rental value less any consideration paid by the employee. As from 1 March 2015, where the accommodation is not owned by the employer but by an unconnected person, the rental value is the lower of the formula value or the arm’s length rental. As from 1 March 2008, no value is placed on the benefit where:

- the supply of any accommodation to an employee away from his usual place of residence in South Africa for the performance of his duties.

- the supply of any accommodation in South Africa to an employee away from his usual place of residence outside South Africa for a two year period, subject to a limit of R25 000 per month. This concession does not apply if the employee was present in South Africa for more than 90 days in the tax year prior to the date of arrival for the purpose of his duties.

CAPITAL GAINS TAX (CGT)

| Inclusion rates* | |

|---|---|

| Companies | 80% |

* No capital gains exclusions apply to companies.

SECURITIES TRANSFER TAX

Securities transfer tax (STT) is payable upon the transfer of unlisted shares. This includes the buying back, redemption or cancellation of shares. STT is levied at 0.25% of the value of the shares transferred and is due within two months after the end of the month in which the shares were transferred.

OTHER

PROVISIONAL TAX

A provisional taxpayer is any person who earns income by way of remuneration from an unregistered employer, or income that is not remuneration, or an allowance or advance payable by the person’s principal. An individual is not required to pay provisional tax if he or she does not carry on any business, and the individual’s taxable income:

- Will not exceed the tax threshold for the tax year; or

- From interest, dividends, foreign dividends, rental from the letting of fixed property, and remuneration from an unregistered employer will be R30 000 or less for the tax year.

Provisional tax returns showing an estimation of total taxable income for the year of assessment are required from provisional taxpayers.

Deceased estates are not provisional taxpayers.

ESTATE DUTY

| Value of estate | Rate |

|---|---|

| R0 to R30 000 000 | 20% of the dutiable amount of a deceased estate |

| Exceeding R30 000 000 | 25% of the dutiable amount of a deceased estate |

Estate duty is levied on the dutiable amount of a deceased estate (property of residents and SA property of non-residents). Deductions include: a standard abatement of R3.5 million per estate (R7 million for a married couple) and certain other deductions, the most important of which is the deduction for property accruing to a surviving spouse.

TRANSFER DUTY

Paid on acquisition of immovable property where the transaction is not subject to VAT. Transfer duty is also payable on the acquisition of residential property through an interest in a company or trust. The rates of duty are as follows:

Years of assessment commencing on 1 March 2020 or ending on 28 February 2021.

| Value of property | Rate |

|---|---|

| R0 to R1 000 000 | 0% of property value |

| R1 000 001 to R1 375 000 | 3% of property value above R1 000 000 |

| R1 375 001 to R1 925 000 | R11 250 + 6% of property value above R1 375 000 |

| R1 925 001 to R2 475 000 | R44 250 + 8% of property value above R1 925 000 |

| R2 475 001 to R11 000 000 | R88 250 + 11% of property value above R2 475 000 |

| R11 000 001 and above | R1 026 000 + 13% of the value exceeding R11 000 000 |

Years of assessment commencing on 1 March 2019 or ending on 29 February 2020.

| Value of property | Rate |

|---|---|

| R0 to R900 000 | 0% of property value |

| R900 001 to R1 250 000 | 3% of property value above R900 000 |

| R1 250 001 to R1 750 000 | R10 500 + 6% of property value above R1 250 000 |

| R1 750 001 to R2 250 000 | R40 500 + 8% of property value above R1 750 000 |

| R2 250 001 to R10 000 000 | R80 500 + 11% of property value above R2 250 000 |

| R10 000 001 and above | R933 000 + 13% of the value exceeding R10 000 000 |

WITHHOLDING TAXES

| Other payments to non-residents | |

|---|---|

| Royalties | 15% |

| Interest | 15% |

| Sportsmen and entertainers who perform in SA | 15% |

| Fixed property acquired in SA from a seller that is a non-resident: | |

| If the non-resident is a natural person | 7.5% |

| If the non-resident is a company | 10% |

| If the non-resident is a trust | 15% |

EXPATRIATE TAX

FOREIGN REMUNERATION EXEMPTION

Foreign remuneration has experienced quite a lot of attention in the past 3 years. What was originally a full exemption under Section 10(1)(o)(ii) is now limited to R1.25 million from 1 March 2020 following Tito Mboweni’s 2020 Budget Speech. This comes after the initial amendment which was promulgated in December 2017 that capped the exemption at R1 million. These changes have caused numerous South Africans to cut ties with the country and it now appears that the government aims to change their approach.

Although it appears that this may bring relief to South African tax residents abroad, the additional R250 000 is mainly wiped out by the effect of the weakening Rand and fringe benefits which will inflate their total package.

Government has proposed to phase in a new exchange control treatment as from 1 March 2021 which is also aimed at reducing the increasing emigration rates. We will see a new verification process with regards to remuneration earned abroad and offshore transfers which allows identical treatment of natural person emigrants and natural person residents.

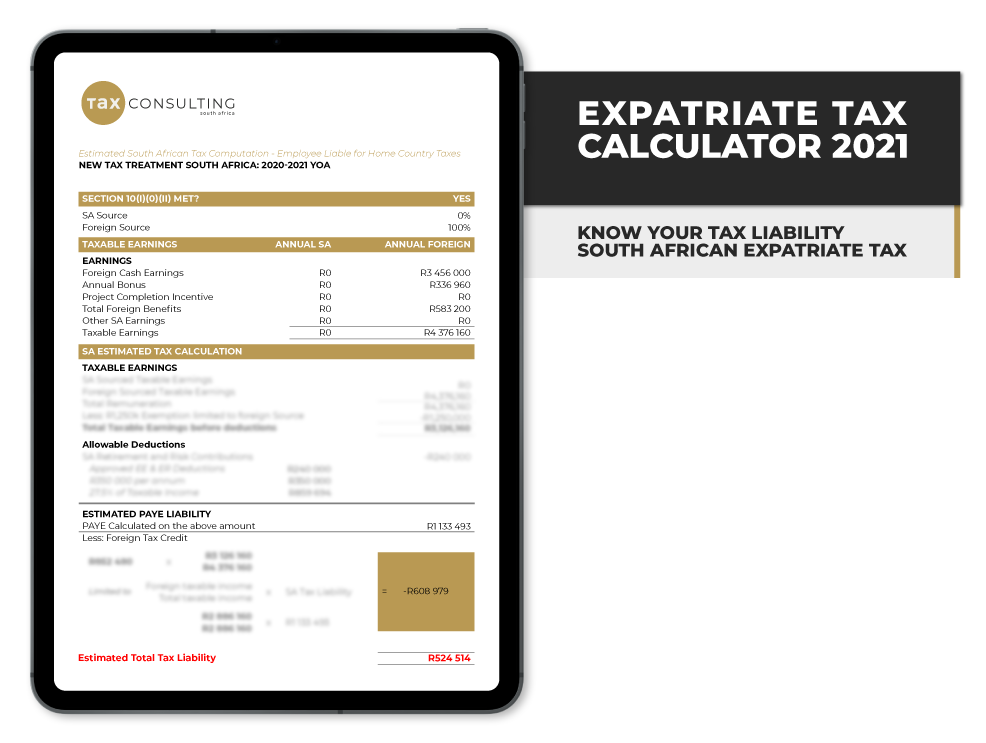

INTRODUCING OUR UNIQUE EXPAT TAX CALCULATOR

In December 2017, the change to the foreign employment income exemption was promulgated into law. This has widely become known as the “expat tax”. The exemption at that point was capped at R1 million, meaning that South African tax residents earning foreign employment income above this threshold would no longer be exempt from tax in South Africa, from the effective date of 1 March 2020.

Stakeholders Warned Government

At every point from the proposal of the amendment to the expat tax, to the promulgation of it into law, and thereafter at various workshops

with National Treasury, stakeholders pleaded with government and warned in no uncertain terms that implementing this change in legislation would lead to an accelerated cessation of tax residency.

The response from government at that point was that the formalization of non-residency in those cases was to be encouraged. This view was shortsighted and has come back to haunt government as South Africans have in many cases chosen to financially emigrate and thus cease their tax residency with South Africa to avoid the expat tax.

South Africa Scrambles to Keep Its Expats

In the 2020 Budget Review, there is a desperate attempt to change the mind of those South African’s formalizing their non-resident status by increasing the exemption cap to R1.25 million. This is of course welcome, but a little too late. The increase will unfortunately assist with only a small group of South Africans working abroad, and merely dangles a carrot for the rest of those abroad to entice them to remain within the South African tax net. The big issue which has been raised on numerous occasions with government is the issue of fringe benefits, which in many cases deplete the exemption before one even considers the cash component of their salary to be taxed.

Financial Emigration – Has it Changed the Minds of Government?

As there has been a massive increase in South Africans ceasing residency to avoid the change in legislation, government has taken notice. The current loss of revenue and potential future loss with South Africans continuing to cease residency means that the expat tax has backfired before it has even become effective.

Government has announced that they will remove some of the emigration formalities from an exchange control perspective, which will take effect from 1 March 2021. These exchange control formalities will be replaced with an uncertain future regime which leaves South Africans with 12 months of some semblance of certainty and to get their affairs in order before a new regime is put in place.

Specifically mentioned is that, “government wants to encourage all South Africans working abroad to maintain their ties to the country.” This must be viewed with some skepticism as government asking a taxpayer to keep ties with the country, and knowing how South African tax residency works, would lead to an attempt to keep the taxpayer within the tax net, while still defending the punitive expat tax.

Government has confirmed that tax residency will still be determined as per South African case law and legislation, being the ordinarily resident test and physical presence test – this comes as no surprise, but does show that government understands that it needs to hold on to its South Africans abroad to ease a flailing tax base. In theory, the financial emigration exit process will in future change from a SARB exchange control perspective, but remains as is from a SARS tax perspective.

Offshore Bank Accounts Beware

With the Common Reporting Standards in full swing, having a hidden offshore bank account is a “luxury” of the past, as information is being shared with revenue authorities around the world. Government has again shown interest hereon by noting that “cooperative practices will remain in place to ensure that South African tax residents who have offshore income and investments pay the appropriate level of tax.”

The simple truth remains that taxpayers must assume any bank account in their name will eventually be known to SARS, so remaining compliant is key while ensuring you are not caught when SARS “asks” about all your world-wide bank accounts.

A Desperate State, it is Too Late

While we can welcome a small increase to the expat tax threshold, as well as hopefully lesser exchange control restrictions for the future, the issue remains – the expat tax is, and will continue to be, disadvantageous for the South African tax resident, as well as for the South African tax base. The tide of South Africans making up their mind to “divorce” South Africa fiscally, formally letting government know their intentions to leave the fiscal net, will probably not be impacted by Budget 2020. To the contrary, it may cause an accelerated effect, as the taxpayer has until 01 March 2021 to exit under a formalized dispensation.

WHAT TO EXPECT FROM SARS IN 2020/2021

WHAT TO EXPECT FROM SARS IN 2020/2021

Since being appointed Commissioner for the South African Revenue Service (SARS), Edward Kieswetter has committed himself to rebuild the institution. The findings of the Commission of Inquiry into Tax Administration and Governance by SARS, and the Commissioner himself have confirmed the fact that State Capture eroded the governance, skills, structures and relationships at SARS.

In pursuit to turn around the institution, SARS adopted a 5-year strategic plan to achieve its 2024 Vision, which is “to build a smart modern SARS with unquestionable integrity, trusted and admired by Government, the public, as well as our international peers.” Put differently, the Commissioner wants to build a revenue authority that provides a world-class service to compliant taxpayers but one that is equally tough on non-compliant taxpayers.

Actions Speak Louder Than Words

The Commissioner has already effected change in several respects, including relaunching the Large Business Centre, the Illicit Trade Capacity has been re-established in the Enforcement division, along with the Compliance Unit.

On 1 February 2020, SARS announced further plans to achieve its objectives. An important part of the strategy is to invest in new technology, to equip SARS officials with the tools and data they need to perform their functions effectively. In addition to this, SARS will embark on an internal and external recruitment drive, to replace the skills lost over recent years and to enrich the gene pool at SARS. In this regard, several executive positions were advertised immediately and appears to have been filled already.

We have also seen some positive signs from SARS that indicate that it is indeed on the mend. SARS has seen some big wins, including a R1 billion tax evasion case at the end of 2019. An encouraging sign is also that taxpayers and SARS officials implicated in tax fraud are investigated properly and some are actually sentenced to imprisonment. Indications that SARS is investigating certain political figures is a further reason to be positive, as it appears that SARS’ approach to enforcement is now in fact without fear or favour.

Concluding Remarks

It is difficult to say how long it will be before SARS will operate as the revenue authority it aspires to be, but it seems that SARS is on the right track. From a taxpayer perspective, we can hopefully look forward to improved service delivery, but perhaps also tighter enforcement and more aggressive collection strategies. This may come as a result of the enhancements in technology and further recruitment of skills, but this can be expected purely because SARS’ hands are tied. With prevailing budget constraints, SARS has to improve its efficiency and collect more revenue.

Over time, we hope that better service delivery and improved enforcement will lead to an increase in tax morality, all of which will augment revenue collection across the board.

![2025-logo-[Recovered] Tax Consulting South Africa](https://www.taxconsulting.co.za/wp-content/uploads/2025/01/2025-logo-Recovered.png)