When a person ceases to be a tax resident, their 12-month tax year splits into two: the portion of the year in which they were a tax resident, and the other portion in which they were a tax non-resident.

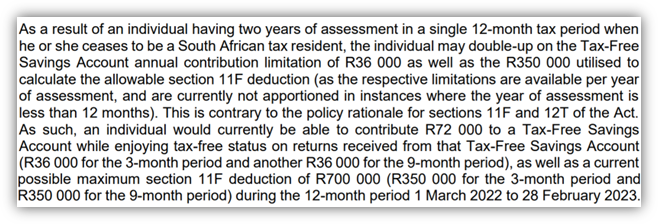

For example, if one ceases to be a tax resident on 1 June 2022, their tax year of assessment as a tax resident would have begun on 1 March 2022, but would be deemed to have ended on 31 May 2022 (i.e., a 3-month year of assessment as a South African tax resident). Their tax year as a non-resident began on 1 June 2022 and ended on 28 February 2023 (i.e., a 9-month year of assessment as a tax non-resident). Both tax years (the 3-month and 9-month periods respectively) fall within a single 12-month tax period.

While the taxpayer still submits one tax return for the (12-month) tax year, SARS will soon take these two periods into account when considering their local retirement fund and tax-free savings account contributions.

While this is nothing new, the National Treasury has stated, on record, that this amendment intends to address an anomaly created by the split-year treatment applicable to taxpayers who cease tax residency:

This means that, currently (and previously), a taxpayer could contribute up to double the annual allowable contribution limits in the year that they cease to be a tax resident, thereby doubling up on these benefits from a tax perspective.

In practice, however, the current tax return form on e-Filing, and of course SARS in determining the tax payable by a taxpayer, has not taken these doubled-up contribution limits into account. Perhaps certain non-resident taxpayers should, therefore, rightly wonder whether SARS currently owes them a refund.

Nevertheless, National Treasury has proposed that from 1 March 2024, contributions made to a local retirement fund or tax-free savings account, in the year where the taxpayer ceases to be a tax resident, will be capped in relation to the time of the year that they ceased tax residency. The new limitations will be determined based on the ratio of days in that tax period (i.e., pre-, or post-cessation), against 365 days.

![2025-logo-[Recovered] Tax Consulting South Africa](https://www.taxconsulting.co.za/wp-content/uploads/2025/01/2025-logo-Recovered.png)