For those choosing to emigrate, a key consideration is tax residency status. Tax emigration isn’t just about physically leaving the country—it requires formally notifying the South African Revenue Service (SARS) of your intent to cease tax residency. This crucial step ensures compliance with international tax laws while mitigating ongoing tax obligations in South Africa.

For South African expats, accessing retirement annuity (RA) and preservation funds becomes possible after the three-year lock-up period. This withdrawal, however, is contingent on obtaining confirmation of your non-tax residency status from SARS.

Early Lump Sum Retirement Withdrawals

Introduced in March 2021, the three-year lock-up rule states that South Africans who cease their tax residency must remain non-resident for at least three consecutive years before they can access and withdraw their full retirement (RA) and preservation funds.

Before this rule, individuals who financially emigrated through the South African Reserve Bank (SARB) could immediately withdraw their retirement savings. However, under the new regulation, SARS requires a minimum of three full years as a non-resident before allowing access to RA and preservation funds.

Tax Treatment for an early withdrawal:

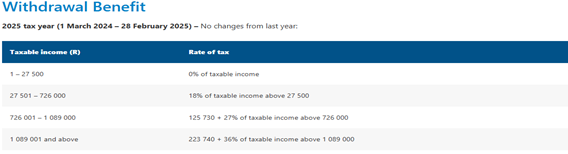

Retirement withdrawals are subject to South African tax at the retirement lump-sum tax tables, which apply progressively (starting at 18% and going up to 36% for large amounts), as shown in the “2025 withdrawal table” below.

Retirement Lump Sum Benefits | South African Revenue Service

Savings Pot Retirement Withdrawals

On the 1st of September 2024 a development to South Africa’s retirement savings framework was introduced, this is known as the two-pot retirement system. Under this new system, expatriates are eligible to make one withdrawal per tax year from their savings pot, without being subject to the three-year lock-in period. This applies to each individual retirement policy held, meaning that if an expatriate has two policies, they may withdraw from both within the same tax year.

Tax Treatment for a savings pot withdrawal:

There are additional benefits of making use of the savings pot withdrawal as an expatriate, this primarily being related to the tax treatment of a savings pot withdrawal. Unlike the early lump sum withdrawals, the savings pot income is taxed on your income tax rate and not a lump sum withdrawal benefit tax rate. The importance of this to expatriates is that where an expatriate is not earning any other form of remuneration in South Africa in the year of assessment that the savings pot withdrawal is made, there is minimal tax on that withdrawal.

The key difference when withdrawing at retirement is that your exemption increases to R550,000. However, it is important to note that only one-third of the policy is tax-exempt. The remaining two-thirds must be converted into a living annuity. Depending on how the living annuity is structured, you will receive monthly or annual payouts, with a maximum drawdown of 17.5% until the funds are depleted. This is not on a lumpsum basis unlike the early withdrawal.

Tax Relief on withdrawals

As a starting point it is important to understand that irrespective of where you are a tax resident and notwithstanding that there may be tax relief or exemptions available, expatriates need to note that before any payment can be released, the fund administrator will need to apply to SARS for a tax directive. The issued tax directive indicates how much tax is to be withheld on the withdrawal before the funds are paid out.

- Double Taxation Agreements

A Double Taxation Agreement (“DTA”) is an internationally binding agreement that allocates taxing rights on income received by tax residents of foreign countries.

Practically, it is often the case that a DTA would allocate the exclusive taxing right to a foreign jurisdiction. Where this arises, the expatriate will be eligible to subject an objection to SARS after the fact, to claim a refund on the tax withheld by SARS on the withdrawal.

Steps to Withdraw Retirement Funds as a Non-Resident

When ceasing your tax residency, you may backdate your cessation from South Africa from the date your intent to remain abroad was established, provided it is supported by evidence. If this confirmation letter verifies your non-resident status for three consecutive years (i.e., minimal time spent in South Africa and no economic ties), you will be eligible to apply for the withdrawal of your RA or preservation fund through the financial institution holding your retirement funds.

When you become eligible to withdraw these funds, you will need to submit confirmation of your tax residency verified by SARS, along with proof of foreign tax residence and all other relevant supporting documents required by the provider. This ensures compliance with regulations and allows for a full lump-sum withdrawal. While this process can be completed by a taxpayer, seeking professional financial guidance is highly advisable to ensure full compliance with all requirements.

Conclusion:

While early lump-sum withdrawals remain subject to South African tax, expatriates can leverage mechanisms such as Double Taxation Agreements (DTAs) and tax credits to minimize their tax burden. Additionally, the new savings pot framework offers greater flexibility for expats seeking to access a portion of their retirement savings without the extended lock-in period.

Given the complexities involved, ensuring compliance with SARS and financial institutions is crucial. Whether you are considering withdrawing your retirement funds, restructuring your investments, or formalizing your tax emigration, seeking expert guidance will guide you in making informed decisions while safeguarding your financial interests.

![2025-logo-[Recovered] Tax Consulting South Africa](https://www.taxconsulting.co.za/wp-content/uploads/2025/01/2025-logo-Recovered.png)