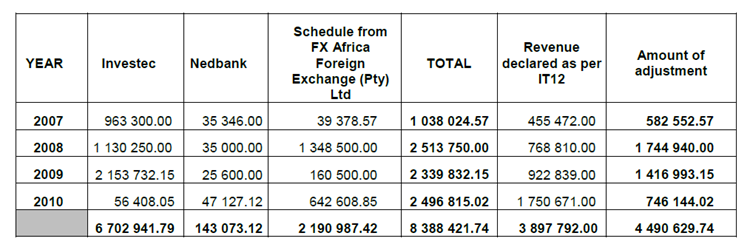

Bank Account vs Tax Return Summary

SARS made it easy for the High Court and presented their case as follows –

The SARS case is simply that they identified deposits received by the taxpayer into his Investec and Nedbank bank accounts, as well as payments received from FX Africa. This did not make it to the tax return and SARS computed that roughly R4,5m was undeclared. They also charged interest and penalties hereon.

SARS Has Full Access to Your Information

Everyone now knows that information from financial institutions, estate agents, car dealerships etc. is not confidential. This is often conveniently ignored and until SARS goes right back and dig into the past, in this case from 2007 to 2010. This is scary for many taxpayers to think that they have to remember their past dating all the way back to over 15 years to remember transactions which happened that long ago. The key is to always retain exceptional records and even where the 5-year record-keeping requirement has passed, a taxpayer with higher income do themselves no favours by not keeping impeccable records.

Operate your Tax Under the Umbrella of Legal Privilege

In our firm, only admitted attorneys are allowed to deal with sensitive matters where privileged information is being shared. This is a protection that wealthier taxpayers simply cannot give up. Where SARS throws the book at you, it often is a good idea to throw the book back at them. At the centre of matters which dates so far back is that the taxpayer bears the evidentiary burden of proof. This is also why the High Court decided that SARS was correct in raising the taxes, not because SARS proved that their assessment was correct, but because the taxpayer could not discharge the legal burden of proof!

Voluntary Disclosure Saves You Penalties

As only attorneys deal with sensitive matters due to the benefit of legal professional privilege, it stands to reason that this is a major advantage that wealthier, errant taxpayers enjoy. The taxpayer, in this instance, may have avoided the imposition of penalties by approaching SARS with a valid voluntary disclosure through the ongoing Voluntary Disclosure Programme (“VDP”) administered by SARS and regulated by the TAA. A valid VDP application also importantly ensures that the taxpayer enjoys full immunity from criminal prosecution.

The prudent taxpayer

There is certainly nothing untoward with receiving amounts in your bank account, however, one must keep in mind that the taxpayer has the duty of discharging the burden of proof in respect of proving that an amount is taxable/non-taxable, as confirmed in legislation and case law. Where a taxpayer has previously not disclosed income, this can be regularised through a valid disclosure under the VDP, and thus the waiving of penalties that would ordinarily be imposed.

A prudent taxpayer will thus always ensure that they keep adequate documentation in order to discharge the burden of proof. The taxpayer in this instance, and in terms of the quantum of the funds received, should have obtained professional advice from a tax practitioner and/or a tax attorney. It remains absolutely critical for taxpayers to be represented by astute tax attorneys not only when navigating the dispute resolution process with SARS, but in all SARS engagements, including the VDP process and when attending to your annual filing obligations. This will ensure you have an effective roadmap and strategy in place when engaging with SARS and to achieve a positive outcome.

![2025-logo-[Recovered] Tax Consulting South Africa](https://www.taxconsulting.co.za/wp-content/uploads/2025/01/2025-logo-Recovered.png)