SARS’ Focus on South Africans Abroad

Over the last few years, SARS has implemented several changes to increase tax compliance among SA expats. A recent change, announced during the 2022 budget speech, included a seemingly simple amendment to the tax laws, making it a requirement for expats working outside of South Africa to file a tax return regardless of their income level, so even those earning below the tax threshold are now required to submit a tax return to SARS.

National Treasury has continuously proposed tax law amendments directed towards expatriates, at least over the last 6 years. Recent proposed amendments include:

- In 2017, the exemption provided to South African tax resident employees working abroad was proposed to be removed for specific categories of taxpayer. In 2018, the proposed removal of the exemption instead shifted to a proposal to limit the provision. In 2019, this was proposed to be capped at the first R1.25 million rand earned by an expatriate from foreign employment each year.

- In 2020, the exchange control aspects of the financial emigration process were proposed to be removed (and were later replaced with a more stringent SARS verification process).

- The introduction of an exit tax on retirement interests where a taxpayer ceases to be a resident. Fortunately, this proposal was not adopted due to the push back received in the public consultation process. It would have been in conflict with the double tax treaties that South Africa has in place with other countries (i.e., a treaty override).

- In view of the split-year treatment applied to a taxpayer who ceases their tax residency, the proposed amendments sought to apportion the annual interest and Capital Gains Tax (CGT) annual exclusion based on when, during a tax year, one ceases their tax residency in South Africa. The proposed amendment was adjusted in allowing taxpayers to utilize the annual exclusion as best suits them, as long as the cumulative annual exclusion utilised during the two tax years (in that twelve-month period) does not exceed the allowable CGT annual exclusion.

A Look into the Future

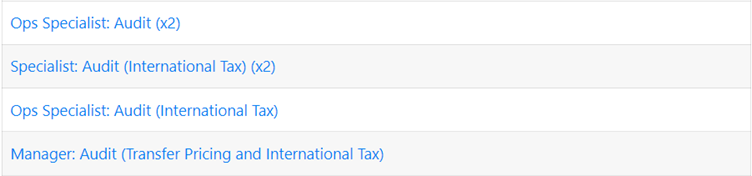

SARS has implemented stricter audits and increased penalties for non-compliance, and the addition of 52 new vacancies to SARS staff suggests that SARS is planning to ramp up these efforts even further – this may lead to an increase in the number of audits conducted. Interestingly, 6 vacancies alone are being dedicated to international tax and/or audits.

The roles suggest that SARS is looking to enhance their human capital to better ensure, or enforce, all-round tax compliance, specifically focusing most of its resources on foreign money, like that of expatriates working offshore.

They are clearly looking for highly skilled candidates, the criteria for most of these positions require very specific technical, behavioural and compliance competencies such as audit methodology; risk identification; persuasion ability; honesty and integrity; fairness and transparency. This all shows that SARS is on a drive to ensure a high standard of compliance, professionalism and thoroughness from within.

Harsh Consequences

Additionally, it is important to note that increased penalties for non-compliance can be severe, and it is crucial for expats to understand their tax obligations and comply with them accordingly. The new reporting requirements implemented by SARS are also likely to cause headaches for expats.

SARS has the power to impose significant fines and penalties on expats who fail to comply with their tax obligations, and let us not forget the interest that grows on such penalties with every passing day the taxpayer is non-compliant.

Historically the budget speech has consistently brought on significant changes for expats working outside of South Africa, and the addition of 52 new vacancies to the SARS staff could lead to stricter compliance enforcement and hence deeper audits. While this may seem daunting, it ultimately aims to ensure that expats are aware of and remain compliant with their tax obligations.

Expats are urged to stay informed about such changes and seek professional advice if they have any concerns around their tax obligations.

![2025-logo-[Recovered] Tax Consulting South Africa](https://www.taxconsulting.co.za/wp-content/uploads/2025/01/2025-logo-Recovered.png)