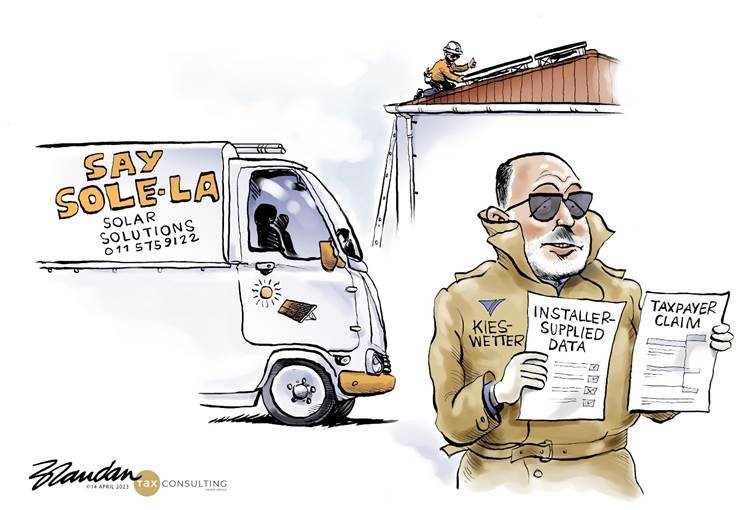

This appears very much part of the SARS drive to ensure compliance and embrace technology for taxpayer data collection. This new announcement considers imposing a requirement on the solar installer to report taxpayer and solar installation information, where the solar installation is affected at a domestic residence.

The draft public notice was issued in terms of SARS’ third-party information gathering laws, which requires select third parties to submit returns containing specific information as detailed by public notice.

Under the current regime, organisations such as banks, financial institutions, listed companies, and medical schemes are required to submit third-party returns to SARS, detailing relevant taxpayer information, transactions, and amounts involved. Solar installers appears next on the list.

Application

The draft public notice was published last month, with a comment deadline of 14 April 2023.

In terms thereof, the responsibility to disclose specified information will fall on a person who issues a solar installation certificate of compliance for the installation of new or unused solar panels, at a domestic residence.

The reporting obligation is aimed at the certificate of compliance issued on completion of a new solar installation.

Compulsory Information

The draft public notice describes some of the mandatory information to be disclosed to SARS thereunder, including –

- Income tax reference number or, if no income tax reference number is available, the identity number, of the person on whose behalf the installation was done;

- Physical address of installation;

- Cost of the solar panels; and

- Date on which they were first brought into use.

Retrospective Effect?

It is propositioned that the draft notice will be backdated to 1 March 2023. Should this be implemented, taxpayers who have installed solar panels at their domestic residences since 1 March 2023, can expect to be reapproached by their solar installers to collect the information which they are required to submit to SARS.

Criminal Sanction

The draft public notice was issued under section 26(1) of the Tax Administration Act, No. 28 of 2011, which outlines SARS’ powers to gather third-party information. It prescribes that certain persons, as designated by SARS via public notice, are required to submit third-party returns.

Section 234(2)(d) of the aforesaid Act provides that any person who wilfully or negligently fails to submit a return to SARS when required to do so, commits a criminal offence. As sanction for such criminal offence, a fine, or imprisonment for up to two years, may be imposed.

It is therefore no surprise that very high SARS reporting standards are implemented by most banks, financial institutions, medical schemes and other organisations currently required to submit third-party returns.

So what does this mean?

The proposed strategic initiative by SARS, as contained in the draft public notice, is an innovative approach aimed at tackling non-compliance as well as enabling the newly proposed tax credits for solar panels. SARS will know exactly who had the money to install solar and the tax refund claim promises to be seamless for compliant taxpayers.

![2025-logo-[Recovered] Tax Consulting South Africa](https://www.taxconsulting.co.za/wp-content/uploads/2025/01/2025-logo-Recovered.png)