The saga of Shauwn “MaMkhize” Mkhize offers a vivid real-life example of the consequences of tax evasion. MaMkhize, a media personality and businesswoman known for her role in the television show “Uzalo,” reportedly amassed much of her wealth through government tenders to build low-cost housing in KwaZulu-Natal. However, her financial success has been marred by ongoing disputes with SARS. Currently embroiled in a tax scandal involving over R37 million in unpaid taxes, this high-profile case illustrates the persistent and far-reaching efforts of SARS to recover owed taxes.

Ghosts of Non-Compliance, Past, Present, and Future

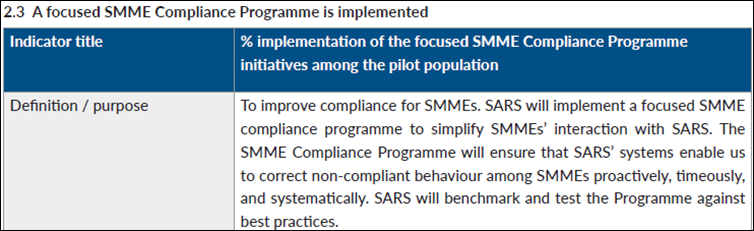

SARS’ strategy to instil a sense of urgency and responsibility among taxpayers’ hinges on making non-compliance both hard and costly. By detecting and addressing non-compliance rigorously, SARS aims to deter tax evasion and ensure that all taxpayers fulfil their obligations.

This approach emphasizes that no taxpayer, regardless of their economic standing, is beyond the reach of SARS’ compliance efforts. Recent compliance trends have also shown SARS considering not just current compliance, but also deep-diving into historic risks of non-compliance, and in some instances, even requesting taxpayer’s to look into their crystal balls and provide SARS of income and expenditure estimates for future tax periods.

Enhancing Voluntary Compliance Through Technology and Trust

With SARS’ enhanced non-compliance detection capabilities and a sharp focus on both past and future non-compliance, correct tax and legal guidance has never been more critical. The most prudent approach to be taken, is to heed SARS’ warning that non-compliance will be both hard and costly for taxpayers.

In order to protect yourself from financial ruin, and even possible jail-time, it remains the best strategy that you always ensure compliance.

Where you find yourself on the wrong side of SARS, there is a first mover advantage in seeking the appropriate tax advisory, ensuring the necessary steps are taken to protect both yourself and your unblemished record, from paying the price for what could be the smallest of mistakes. However, where things do go wrong, SARS must be engaged legally, and we generally find them utmost agreeable where a correct tax strategy is followed.

As a rule of thumb, any and all correspondence received from SARS should be legally addressed, as often legal professional privilege is a must in instances of non-compliance. This will not only serve in safeguarding against SARS implementing collection measures or potentially criminal charges, but also being specialists in their own right, taxpayers and practitioners will be correctly advised on the most appropriate solution to ensure full tax compliance.

![2025-logo-[Recovered] Tax Consulting South Africa](https://www.taxconsulting.co.za/wp-content/uploads/2025/01/2025-logo-Recovered.png)