Complete and Correct Disclosures Essential

As a South African resident taxpayer, all income earned, whether primary or secondary, and regardless of source, must be disclosed to SARS. This transparency ensures that taxpayers meet their legal obligations and contribute fairly to the country’s revenue collections. When taxpayers fail to disclose secondary income, they not only breach legal requirements but also risk severe penalties and criminal prosecution.

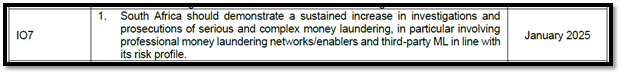

These wide-spread under-declarations have been brought into focus now more than ever and is a key contributing factor to South Africa’s commitment to meeting the Financial Action Task Force (FATF) standards, particularly in enhancing its Anti-Money Laundering and Combating the Financing of Terrorism (AML/CFT) regime. This includes escalating investigations and prosecutions of serious and complex money laundering cases, in terms of Immediate Outcome 7.

It remains crucial for taxpayers to address their tax obligations promptly – he longer you delay, the higher the risk of facing severe penalties, including criminal prosecution. Proactive measures can significantly reduce your exposure to these risks. There is always reprieve for the aggrieved, where pro-active steps are taken.

Voluntary Compliance is Key

For taxpayers who have historically not disclosed all their income, the Voluntary Disclosure Programme (VDP) offers a reprieve for errant taxpayers. The VDP allows taxpayers to rectify their tax affairs voluntarily before SARS initiates any action and is critical where taxpayers have historically submitted their tax returns but have undisclosed income that remains undetected by SARS.

The VDP is available only to taxpayers where SARS is unaware of the tax default. It provides an opportunity to regularise tax affairs with reduced penalties and without the risk of criminal prosecution, as long as the disclosure is made before SARS begins an investigation. Failure to utilize the VDP can result in severe consequences, including criminal prosecution, which is a growing focus under Immediate Outcome 7 (IO7):

Excerpt from National Treasury Media Statement “FATF Greylisting”: South Africa’s Progress in Addressing its Action Plan as at 28 June 2024

Alternate Avenue for Resolution

Where you have failed to even file your tax returns, and your apprehension in meeting this legal obligation stems from the insurmountable nature of the ensuing tax debt, it is important to take cognisance of the tax debt relief measures as contained in the TAA. Where a taxpayer does not have legal merits to pursue an objection or does not meet the voluntariness or compliance requirements of a VDP, but has difficulty in settling their tax debt, a Compromise of Tax Debt application (“the Compromise”) may be available.

The Compromise is aimed at aiding taxpayers to reduce their tax liability by means of a Compromise Agreement (“the Agreement”), which is entered into with SARS. Where SARS is approached correctly, and the taxpayer’s financial circumstances warrant it, a tax debt can be reduced, and the balance paid off in terms of the Compromise.

The Role of Legal Professional Privilege and a Multi-Faceted Team

Navigating the complexities of tax compliance, considering the intricacies and hybridization of legalities and SARS’ own processes and protocols, requires professional expertise. Legal professional privilege is essential to ensure that taxpayers receive confidential and privileged advice when disclosing income or correcting tax defaults. A multi-faceted team comprising tax advisors, legal professionals, and financial experts can provide a holistic approach to compliance.

Such a team can guide taxpayers through the VDP process, ensuring that all disclosures are accurate and comprehensive. This collaborative approach helps mitigate risks and ensures that taxpayers meet their obligations while benefiting from the protections offered by the VDP.

Where taxpayer’s do not meet the eligibility requirements for a VDP, there remain alternate relief mechanisms available – when SARS are correctly and legally approached, there is always a reprieve for the errant taxpayer.

In the end, total tax compliance is the ultimate goal, be it through the rectification of an incorrect disclosure, or securing a settlement which is more affordable to the taxpayer in a given instance!

![2025-logo-[Recovered] Tax Consulting South Africa](https://www.taxconsulting.co.za/wp-content/uploads/2025/01/2025-logo-Recovered.png)