Unlike its predecessor, the Act serves to provide grounds of disqualification from practicing as a property practitioner, including, but not limited to, not being in possession of a valid tax clearance certificate (“TCC”). The knock-on effect here is the Agents are then unable to procure / renew their Fidelity Fund certificate (“FFC”), which has always been an express requirement for practicing as an Agent.

As per the Act, section 50(a)(vii) provides that the Property Practitioners Regulatory Authority (“the Authority”) may not issue a FFC to any person who is not in possession of a valid tax clearance certificate.

This additional statutory requirement emphasises the importance of tax compliance, which if not in order, may permanently turn off the lights in a non-compliant Estate Agency.

Compliance, from the Ground Up

In considering the Act, cognizance, must also be had for the Property Practitioner Regulations, 2022, of which, chapter 5, pertaining to the form and deadlines for FFC, expressly notes that all applications for renewal must be lodged by no later than 31 October, in the calendar year in which the current certificate expires.

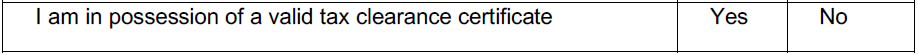

In terms of the form of application, regarding the issue of a FFC or Registration Certificate to a Property Practitioner, the Act stipulates the substance and form of the required application, which importantly includes a declaration by the applicant that they are in possession of a valid Tax Clearance Certificate (“TCC”):

A TCC serves as confirmation, issued by the South African Revenue Service (“SARS”), that a taxpayer’s tax affairs are in order, and that they are fully compliant from both a returns/documentary and liability perspective. In order to avoid this disqualification, it is of utmost importance that Agents ensure optimal tax compliance, both historic, and current.

For the purposes of the Act, which even though expressly mentions the TCC, the applicable TCS application would be that of “Good Standing”. This application will then provide the taxpayer with a PIN, which a 3rd party, may use to verify the taxpayer’s status via the online platform of SARS e-Filing, on an on-going basis, which status will change in accordance with the taxpayer’s current state of affairs.

Historic Landmarks

Any historic or current non-compliance, must immediately be remedied with the revenue authority, which includes:

- Historic and / or current outstanding tax returns;

- Money owed to SARS, which liability is not subject to a Suspension of Payment, Deferral of Payment, or Compromise of Tax Debt Application;

- Non-compliant or Deficient registrations for applicable tax types;

- Inaccurate historic disclosures; and

- Material non-disclosures.

The knock-on effect of non-compliance with SARS can be far reaching, affecting not only the careers of the Agents, but also their personal lives should SARS opt to implement any collection measures against them, taking the form of 3rd Party Appointments, Final Demands, or in exception circumstances, Garnishee Orders.

It must be noted that now is not the time to take risks. SARS’ approach clearly shows we are dealing with a competent revenue authority, which with the implementation of AI system improvements, and the additional power imputed by teaming up with the National Prosecution Authority, is fast gaining momentum in its collection drive.

The First-Mover Advantage

In order to protect yourself from SARS and abide by the soon to commence Property Practitioner Act and Regulations, it remains the best strategy that you always ensure compliance. Where you find yourself on the wrong side of SARS, there is a first mover advantage in seeking the appropriate tax advisory assistance, to ensure the necessary steps are taken to protect both yourself and your real estate career from paying the price for what could be the smallest of mistakes. However, where things do go wrong, SARS must be engaged legally, and we generally find them to be agreeable to the utmost where a correct tax strategy is followed.

As a rule of thumb, any and all correspondence received from SARS should be immediately addressed, by a qualified tax specialist or tax attorney, which will not only serve to safeguard the taxpayer against SARS implementing collection measures, but the taxpayer will also be correctly advised on the most appropriate solution to ensure their tax compliance.

![2025-logo-[Recovered] Tax Consulting South Africa](https://www.taxconsulting.co.za/wp-content/uploads/2025/01/2025-logo-Recovered.png)