International Tax and Double Tax Agreements 101

The application of double tax treaties may very well find application, and is obviously an important part of international tax planning consideration. This is, however, a complex area of tax and application of rules differ between countries. We often see even local South African tax experts getting this wrong, so please just work with caution and any informal view should always be professionally signed-off. Also, just at a practical level, two initial comments –

(a) Tax treaty relief is something which must be claimed by a taxpayer and SARS must agree thereto. Under no circumstances should anyone, even remotely, assume they can read the DTA, determine they qualify for tax relief, and then close the book to just carry on with life. The use of DTA relief is subject to mutual assistance and agreement procedures. For example, where you are based in the United Kingdom, SARS would ask for a tax residency certificate before considering the DTA. There are very well set protocols to adhere to and the correct process must be followed to make this claim.

(b) When applying a new DTA, such as the one with the United Arab Emirates of 15 December 2016, we would be extra cautionary on relying on its provisions, but that does not mean it is not available. The answer here will be determined by domestic rules and how jacked the UAE Revenue Authority is with tax treaty application at local level. Conversely, we are always sensitive to SARS’ own ability to first-time accurately interpret international tax law correctly. As practitioners who deal herewith daily, my recommendation is to rather use domestic law for planning as SARS is well versed herewith. However, where you are in a corner and claim DTA tax exemption, that may always remain a last resort. Yes, you can fly through a large thunderstorm, but first try and avoid it.

Let’s now deal with the technical application –

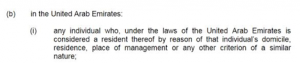

1. The treaty only applies to where you are considered tax resident in both the contracting states. This means you need to be not just tax resident in South Africa, but also tax resident in the UAE. The technical reference for this is Article 4(2)(b) of the UAE DTA –

2. What we are unsure off is whether expatriates from South Africa to the UAE are tax resident in the UAE. Please note this is not work permit resident or right to reside, but “tax resident”. The rub will be whether one can get a UAE tax residency certificate, issued by the UAE Revenue Authorities, stating the tax status for purposes of the DTA as same. Let’s assume this hurdle can be overcome.

3. Now you have a position where someone is a South African tax resident under the South African tax law, and a UAE tax resident under UAE law. Tax treaties operate on the very clear principle that you can only be tax resident in one country. This is a founding principle. To address such a conflict, the DTA contains what is known technically as the “tie-breaker” clause. There are certain tests you follow, and as one applies to both countries or neither countries, you go to the next test. Ultimately there will always be a result, and if all tests fail, SARS and the UAE Revenue must negotiate your status under sub-article 4(2)(d).

4. These tie-breaker tests are contained in sub-article 4(2) and reads –

5. Now, I am a bit worried about the self-help readers and the above clause. They read it, [think] they understand the above, and then form an opinion. It is compulsory to acquire the OECD commentary on these tests and study this yourself, as well as case law hereon, before forming your own view. Acquiring the expertise to interpret the myriad factors of consideration impacting and knowing how to apply and challenge takes many years of practical application and practice.

6. But if you want a quick answer, where you do not have permanent residency in a location, i.e. the right to stay indefinitely, the odds are not in your favor to argue that you have a “permanent home”, “centre of vital interests” or “habitual abode” in the UAE. Thus, rather try to fly around this thunderstorm.

7. Where the tie-breaker works against South Africa, you will be non-resident for tax and this means the new rule does not apply to you. However, there will still be a deemed disposal for CGT triggered by this and you will still need to comply with the associated Reserve Bank requirements.

We will share more later on typical solutions under separate cover, as well as possible approached to support a lobby pre-promulgation of the new law.

![2025-logo-[Recovered] Tax Consulting South Africa](https://www.taxconsulting.co.za/wp-content/uploads/2025/01/2025-logo-Recovered.png)