To most effectively use the discretion afforded to the Commissioner, the nation’s tax authority has turned to Artificial Intelligence (AI) to bolster its auditing capabilities. Leveraging cutting-edge AI algorithms over raw man-power, SARS aims to cast their collection net as wide as possible, including on future taxes.

This AI capacity bolstering technique has already been seen across SARS’ historic audit processes, being used to maintain thoroughness and accuracy, whilst deriving data driven insights almost instantaneously. This move underscores a broader trend towards the integration of technology in tax administration, promising to revolutionize the way tax compliance is monitored and enforced.

Data-Driven Insights Doom Non-Compliant Taxpayers

Intensifying the pressure on all taxpayers, but specifically HWI who has dedicated SARS relationship managers peering into their affairs regularly, the revenue collector has been raiding 3rd party data sources to pick-up any semblance of non-compliance.

These data driven insights inform SARS of all transactional records pertaining to specific taxpayers, and using AI, the “fine-tooth comb” is no longer needed to extrapolate these records into strong legal cases for non-compliance. This collaborative approach enables SARS to gain access to a comprehensive dataset, facilitating more robust evaluations of taxpayers’ financial activities.

Beginning a compliance initiative with the end in mind, is something SARS is known for, which may very well be the case here; by ensuring there is full disclosure of all interests, both local and foreign, gauging if a taxpayer is living beyond their means, becomes that much less onerous on the revenue authority, and more a case of capitalising on data driven insights.

For HWIs managing intricate financial portfolios, these developments signal a need for heightened diligence in tax record keeping and reporting, with SARS clear in its mandate to collect revenue and eradicate non-compliance by whatever means necessary!

Wealth Seeking Missiles Launched

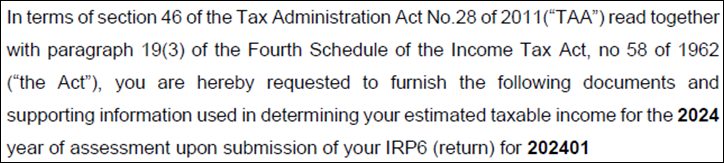

HWIs can anticipate heightened verification protocols from SARS. Recently, individuals have reported receiving letters from SARS requesting detailed information regarding provisional taxes. These requests, citing specific legislative provisions, highlight the meticulous scrutiny under which HWIs’ tax affairs are now placed.

When viewed in conjunction with the Approval for International Transfer process imposed as of April 2023, being applicable for outbound fund movements, usually in large sums of money, the net is tightening on the wealthy.

This aligns perfectly with a smarter, modernised SARS, which access to 3rd party data, has already proven effective in instances such as that of Airbnb Ireland last year – the introduction of the AIT process is not to be taken lightly as where taxpayers are not forthcoming, SARS most likely already knows what you think you’re hiding.

Navigating the Next 6 Months, for the Rest of Your Life

As the filing season approaches, HWIs are bracing for a period of increased strain. With SARS’ enhanced audit capabilities and a sharper focus on verification, ensuring compliance has never been more critical. The next six months are poised to test HWIs’ ability to navigate evolving tax regulations and demonstrate meticulous record-keeping.

The most prudent approach to be taken, is to heed SARS’ warning that non-compliance will be both hard and costly for taxpayers. Where taxpayers find themselves in a potentially precarious position of now disclosing previously undeclared interests, or foreign income, the best practice is to seek the assistance of a tax professional, ensuring the best compliance strategy is followed.

However, in the event that a taxpayer has already undertaken the disclosure themselves, and a subsequent audit ensues, enlisting seasoned tax attorneys to help navigate the complex nuances of tax legislation will optimise a taxpayer’s compliance, thus preventing potential prosecution and the loss of “luxury” assets.

![2025-logo-[Recovered] Tax Consulting South Africa](https://www.taxconsulting.co.za/wp-content/uploads/2025/01/2025-logo-Recovered.png)