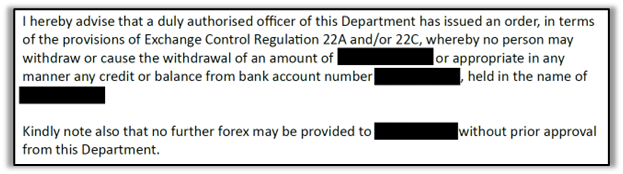

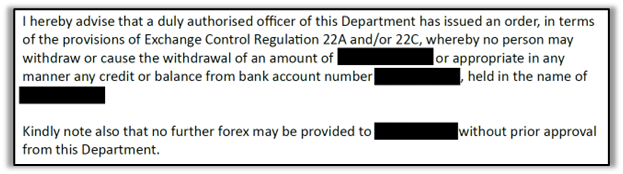

Whether transferring money abroad for arbitrage, investment, travel, or exploring potential emigration opportunities, South Africans are subject to strict banking and exchange control regulations enforced by the South African Reserve Bank (SARB). Failure to comply may result in hefty fines and or even blocked bank accounts:

Enlisting assistance from experienced exchange control attorneys is essential to navigate South Africa’s exchange control framework, ensuring compliance and avoiding pitfalls.

What is the Single Discretionary Allowance (SDA)?

Every South African resident adult (18 years and older) may transfer up to R1 million offshore per calendar year under the SDA, without needing clearance from the South African Revenue Service (SARS).

What is all the talk about Financial Emigration?

With tens of thousands of South Africans departing from the country every year to start a new life overseas, many embark on the financial emigration process with SARS to update their statuses to tax non-residents.

Individuals who have applied to SARS to become tax non-residents are further required to align their banking statuses with their Authorised Dealers (local South African banks) under South Africa’s exchange control regulations. This will entail the conversion of their local bank accounts to non-resident accounts, with certain restrictions ranging from relinquishing their SDA to the potential loss of credit facilities being imposed.

Those non-resident South Africans seeking to transfer their remaining funds abroad will be required to present their local banks with formal approval and clearance from the South African Revenue Service (SARS). Whether transferring funds from savings, properties sold or liquidated retirement annuities, local banks will first require an Approval for International Transfer (AIT) Tax Compliance Status (TCS) PIN from SARS.

What does Approval for International Transfer (AIT) mean?

For any transfers by tax non-residents, or where tax residents transfer more than R1 million per annum, local banks will require a valid AIT TCS PIN from SARS. This AIT TCS PIN provides local banks with a mechanism to verify the tax compliance status of a taxpayer and authorise outbound international transfers.

For international transfers exceeding R10 million, approval from the Financial Surveillance Department of the SARB is required beyond the AIT TCS PIN. Each AIT application is unique, requiring detailed and technical disclosures relating to the source and destination of the funds to be transferred abroad. SARS will further require insight into the taxpayer’s local and foreign assets as well as liabilities for the 3 years preceding the application.

Processing time?

The SARB advises the processing time for applications submitted to the Financial Surveillance Department is between two and four weeks, depending on the nature and complexity of the application. This excludes the time taken to process the application at the Authorised Dealer prior to its submission.

Conclusion

Misconceptions around allowances, required disclosures, the types of approvals, and the reporting of overseas transactions can easily lead to costly mistakes. Embarking on international transfers and exchange control applications requires precision and strategic planning. Partnering with the right team of skilled exchange control professionals is critical to ensure a seamless transfer process while keeping you on the right side of the law.

![2025-logo-[Recovered] Tax Consulting South Africa](https://www.taxconsulting.co.za/wp-content/uploads/2025/01/2025-logo-Recovered.png)