Finding themselves in multiple tax jurisdictions for prolonged periods, expats are either exposed to excessive taxation or they neglect their taxes altogether.

The equation is complicated by the fact that the South African Revenue Service (SARS) has increased its scrutiny when it comes to this segment of the tax base, which means non-compliance is no longer an option. The general renaissance at SARS means the revenue authority is becoming more proactive in pursuing expatriates who have until recently enjoyed minimal taxation on their foreign earnings.

The upshot is that the task of understanding this sphere of taxation by tax consultancy firms, payroll departments and global mobility specialists and the individuals themselves is becoming increasingly challenging.

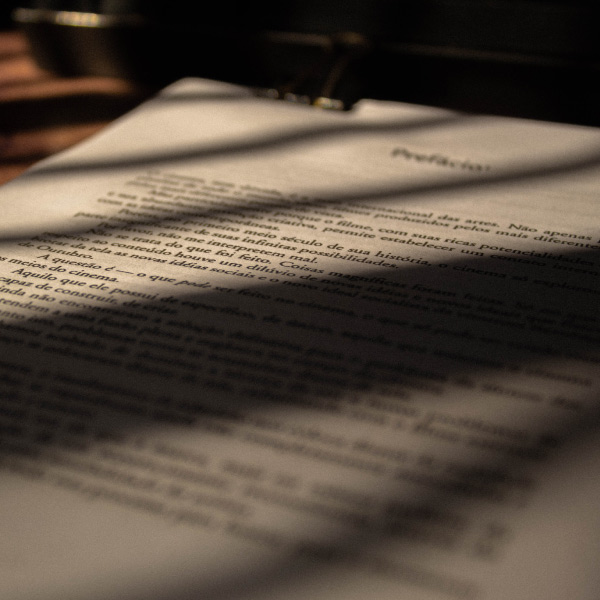

The birth of the ultimate expatriate tax textbook

Taxation on expatriates was dealt a blow back in 2017 when SARS attempted to repeal the tax exemption on foreign earned employment income. Though the decision was successfully opposed in Parliament through a joint effort by the Expatriate Petition Group and Tax Consulting South Africa, government decided instead to cap the exemption at a R1m threshold (later increased to R1,25m), which would only come into effect from 1 March 2020.

In 2019, anticipating the serious impact the implementation of the amendment would have on taxpayers working offshore, as well as foreigners working in South Africa, LexisNexis approached Tax Consulting SA to compile a guide that would equip readers with a better understanding of expatriate taxation and its constituent elements. Being the largest independent tax practice in South Africa and having a team of technical and legal tax specialists under one roof, the firm was not only at the forefront of current legislative changes, but they were able to dip into a diverse pool of experience.

With such a vast subject, the first challenge in compiling the body of work was deciding what to include in the textbook and what to exclude. The authors erred on the side of caution and created a comprehensive work that unpacked the applicable legislation and the relevant aspects that informed expatriate tax obligations.

The textbook, Expatriate Tax: South African Citizens Working Abroad and Foreigners in South Africa, was launched as a first of its kind tax guide that offered phenomenal insight into a previously unexplored area. Judge Dennis M Davis, Chairman of the Davis Tax Committee and Emeritus Judge President of the Competition Appeal Court, provided a powerful foreword, which stated that the textbook offered a clear interpretation of the tax implications for those who found themselves facing tax in multiple jurisdictions.

In keeping with the nature of the subject matter, the book was technical in style, though not overbearingly so. Great care was taken to include practical explanations and examples, thereby relaying the information without being ambiguous in its interpretation. As much as the book was intended as a reference guide or workbook for tax, remuneration and global mobility specialists, its contents had to be crisp and understandable enough for ease of application to any expatriate scenario.

Misinterpretation and tax law changes precipitated the need for a revised edition

After the implementation of the capped exemption, expat tax quickly became a hotly debated topic. One group believed that the sudden exposure to taxation would nudge expats towards financial emigration. Another group maintained that the inclusion of all employee benefits under income, would cause employers to relook their remuneration structures and ultimately reconsider the employment of South African professionals.

The effect of remuneration strategies, work permits and exchange control regulation on an individual’s personal income tax, was suddenly placed under the spotlight. Further uncertainties surrounding Double Taxation Agreements between two countries and the ceasing of one’s tax residency, created a furore among expats.

At the same time, SARS began pursuing tax offenders with renewed vigour. By conducting audits on South Africans who attempted to cease their tax residency, SARS made it clear that expatriates were the first in the firing line. Subsequently, the tax exemption threshold was raised to R1.25m, with further changes brought to the formal emigration process through the South African Reserve Bank from 1 March 2021.

These changes and the need for a clearer interpretation of the many grey areas that arose, Tax Consulting SA set out to compile a revised edition that would address the intricacies that sparked a retaliatory mindset among expats.

Who stands to benefit from reading it?

Expatriate Tax is an essential reference work that stands out, simply because it is currently the only work that speaks to this specialised area of taxation. This makes it invaluable reading for specialists across a vast number of industries, including finance, immigration and human resources.

South Africans with international interests, global mobility specialists, chartered accountants, attorneys, tax experts, financial advisors, SARS or National Treasury officials, real estate professionals, or the like, will all find this handbook extremely useful in their respective trades. Even individual taxpayers with an interest in the finer points of taxation law, will be able to apply it to their personal tax affairs.

![2025-logo-[Recovered] Tax Consulting South Africa](https://www.taxconsulting.co.za/wp-content/uploads/2025/01/2025-logo-Recovered.png)