The Reality of Non-Compliance

This statement has never rung so true for a taxpayer, as when he was served with a summons to appear in the Magistrate’s Court, being charged on not 1, but 29 counts of non-compliance!

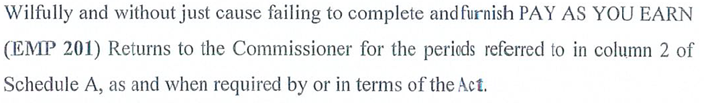

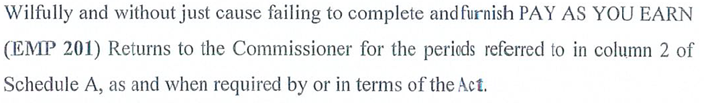

Without limiting any prospects of recovery, the revenue authority evidently did its homework, and duly investigated the behaviour of the taxpayer, with counts 1 – 11 above, pertaining to the non-submission of the taxpayer’s PAYE returns, which is an integral part of the operations in any business.

The same can be said for counts 12 – 24, which focused entirely on the non-submission of the taxpayer’s VAT returns and counts 25 – 29 canvassing the taxpayer’s non-compliance from a Corporate Income Tax perspective.

The Threshold of Non-Compliance

SARS has certainly made good on its word of increasingly focusing on non-compliance, including tax mistakes, which enable the prosecution of taxpayers for offences committed “wilfully and without just cause”.

Matters of non-compliance are not to be taken lightly by taxpayers, and even the smallest mistake can land you in serious hot water, with the Hawks knocking at your door, to personally deliver your invite to a rendezvous with the revenue authority.

The SARS Solution to Non-Compliance

As evidenced in recent months, and in light of the on-going COVID-19 pandemic, our insight in the market has noted SARS upping its collection power to offset a massive budget deficit with aggressive collection steps including salary garnishes, Sheriff callouts and even taking money directly from business and/or personal accounts.

Now is not the time to take risks. SARS’ approach clearly shows we are dealing with a competent revenue authority, so why risk it when compliance is evidently the preferred way forward, which SARS is willing and ready to assist all taxpayers with, as advised by Commissioner Edward Kieswetter, stating that SARS will do its best to “make it ease and seamless for taxpayers when they transact with the organization”.

This statement, when SARS is correctly legally engaged, is evidently made by a revenue authority that is steadily aligning itself with international standards and climbing back to its former prestige as one of the world’s finest.

The Best Strategy to Remedying Non-Compliance

In order to protect yourself from possible jail-time, it remains the best strategy that you always ensure compliance.

Where you find yourself on the wrong side of SARS, there is a first mover advantage in seeking the appropriate tax advisory, ensuring the necessary steps are taken to protect both yourself and your unblemished record, from paying the price for what could be the smallest of mistakes. However, where things do go wrong, SARS must be engaged legally, and we generally find them utmost agreeable where a correct tax strategy is followed.

As a rule of thumb, any and all correspondence received from SARS should be immediately addressed, by a qualified tax specialist or tax attorney, which will not only serve to safeguard the taxpayer against SARS implementing collection measures, but also being specialists in their own right, the taxpayer will be correctly advised on the most appropriate solution to ensure the healing process is completed.

![2025-logo-[Recovered] Tax Consulting South Africa](https://www.taxconsulting.co.za/wp-content/uploads/2025/01/2025-logo-Recovered.png)