UPDATE ON SOUTH AFRICAN TAX ON EXPATRIATE EMPLOYEES AND VARIOUS CLIENT QUESTIONS / RESPONSES TO SOME SOCIAL MEDIA COMMENTARY

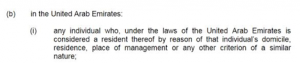

The National Treasury announcement of taxes on expatriate employees, where no exemption under section 10(1)(o)(ii) will be allowed where there are not actual taxes paid in the host country, has resulted in considerable comment and debate. We wish to publish this second notice to assist those South African taxpayers who wish to be fully compliant, yet optimally structured, to guide them through the myriad of issues to be considered.

I was once “asked” by a wealthy United States businessman what he is missing with the South African taxpayer public. In the United States, he mentioned, no one will ever talk socially about not paying their taxes or doing anything remotely wrong. You never know who is listening. He was bemused that in South Africa there is open talk and bragging about not paying one’s taxes; as if SARS criminal auditors cannot access Facebook groups and cannot see posts, years from now. In the United States they at least have a strong tax paying culture, so if you do not pay your share, society turns on you. Arguably we are far from this in South Africa, but if you have been naughty and feel the desperate need to tell the world, perhaps one should consider that if someone does not like you, they can always do a SARS tip-off through a simple website form.

Therefore, please approach with caution the comments by various self-proclaimed tax journeymen, and whilst there are many half-truths doing the rounds, some views are simply dangerous and others so clueless that one only hopes that no-one will stake their livelihood on these views. One may guess anyone who has cheated the taxman somewhere can put themselves out as a charlatan, but that hardly makes their opinion worth following.

Some quick thoughts on posts –

SARS cannot find me, so I am ok

Well actually nothing can be further from the truth. Google FATCA and CRS, as well as see the activated agreements at http://www.oecd.org/tax/automatic-exchange/international-framework-for-the-crs/exchange-relationships/#d.en.345426. Select South Africa in the receiving drop down menu to see who is sending the data to South Africa. This is off course only the start, as Mauritius and other international locations are all joining.

Offshore tax evasion has become a growing concern worldwide, and governments and financial institutions have become much more aware of the large amounts of undisclosed wealth held in offshore accounts. In an effort to combat tax evasion the global version of the United States’ Foreign Account Tax Compliance Act (FATCA), known as the Common Reporting Standard (CRS), came into effect in South Africa on 1 March 2016. CRS is the global standard for the automatic exchange of financial account information and extends to all accounts held by entities and individuals with foreign tax obligations and entities with controlling persons who have foreign tax obligations.

Therefore, they do not care so much where you are, but more where your bank account is located. Your South African passport triggers the global reporting, which ends up with SARS. Granted, the wheels of the law turn slowly. But you may have already been reported, thus you need to make sure your ducks are in a row. Actually, this is exactly the reason for the SARS Special Voluntary Disclosure Programme which is currently active and running.

SARS have accepted my non-disclosure, so I am in the clear

Where you have not made full and correct disclosure on your personal tax return, there is no prescription. This means SARS can open this years from now and assess you correctly, with penalties and interest.

The automatically generated SARS assessment does not mean you have passed verification; and even where you have been verified, you have not been audited. Where you have been audited, you would know you have been audited, as this is a painfully intrusive process.

SARS will need to prove my status and that I am at fault

Unlike criminal law, in tax law you are guilty until you can prove yourself innocent. This is called the “onus of proof” requirement – see section 102 of the Tax Administration Act 28 of 2011. Most tax court cases are lost in South Africa as the taxpayer cannot discharge the onus of proof.

This is why, as tax professionals, we have difficulty in explaining tax planning requirements and documentary processes to clients. The question often asked is where does it say I “must” do this. The answer is, nowhere. Where you cannot defend your tax position adopted on a balance of probabilities, the tax case will go against you.

SARS lacks capacity and competence

This may be true, so you may be correct, for now. However, just because you committed theft 20 years ago, does not mean you are pardoned. Some of our most complex tax cases we have had to defend, dates to events 10 to 15 years ago, often sins of the forefathers, which caught up with the next generation. SARS may be a bit weak now, but they will rise again and head-hunt the skills and expertise to audit backwards. It is on these cases where 200% penalties come into play and if you have not seen the TAA compulsory penalty chart, please let us know and we will do a post.

The tax law change will only come into play in two years

Would you like to bet something, to have skin in the game? SARS needs to urgently collect more taxes. Do you know of any tax law amendments announced in the National Budget process, which was not implemented in the same year, some retrospective, some from date of promulgation and, at best, 01 March [2018] onwards?

There is nothing one can do now, before the law is not implemented

This is a view, but probably not a good view. If you want to claim non-residency status and have not done this correctly, it is a no-brainer that sooner is better. If you have been submitting no returns, it would be a good idea to catch-up now, simply being a compliant taxpayer makes sense at various levels. Where you have done incorrect (zero) tax submissions, you are high risk and should regularize.

There is of course plenty more which can be said, but I will allow comments to run for a while, before responding again. Need to do some real work as well. My next post will be on the actual recommended steps which should be considered to be optimally planned.

![2025-logo-[Recovered] Tax Consulting South Africa](https://www.taxconsulting.co.za/wp-content/uploads/2025/01/2025-logo-Recovered.png)