There are, however, two fundamental risks with such more detailed disclosures –

1. The data is there to show South Africa is not doing well or on the Right Trajectory

There is ample information showing that South Africa faces serious challenges. Some of these will be unpacked in TaxConsulting’s Budget 2024/25 presentations on the morning and afternoon of 27 February 2024. Whilst these sessions are more on the tax technical changes and aimed professional education, the context of the budget remains important. This explains for example, when dealing with clients there would always be a leaning towards “financial emigration” whereby they financially de-risk them from South Africa. Even for returning South Africans, the trend often is to buy a property and vehicle with cash; but they keep their wealth offshore and mostly in correctly setup structures. South Africa remains a great place to live for many, and perhaps even is becoming better for those with a bit of money, due to the weakening currency. However, the underlying data and projections show there are many challenges and better options internationally to protect and grow wealth.

2. Seeing ghost, where there are none

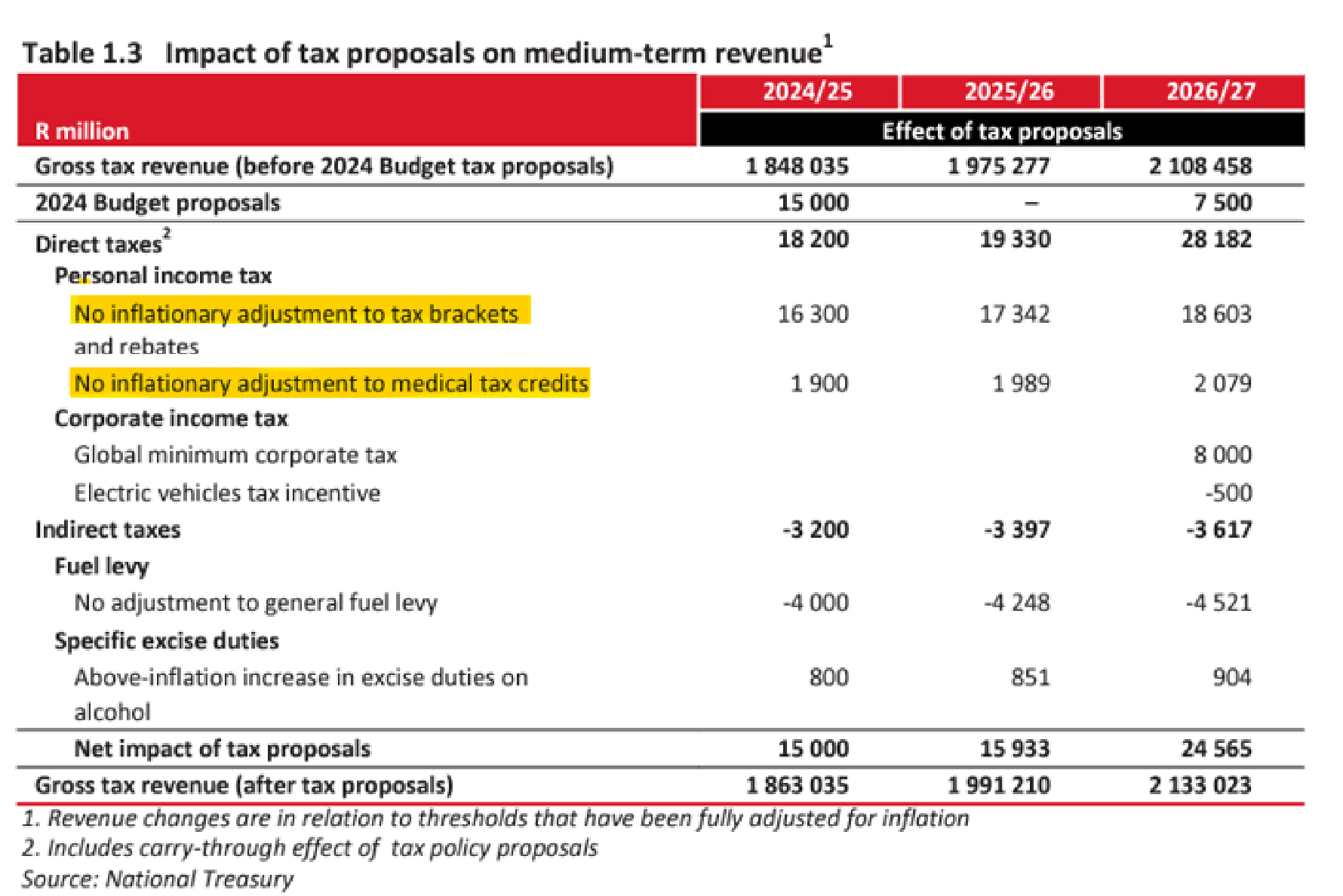

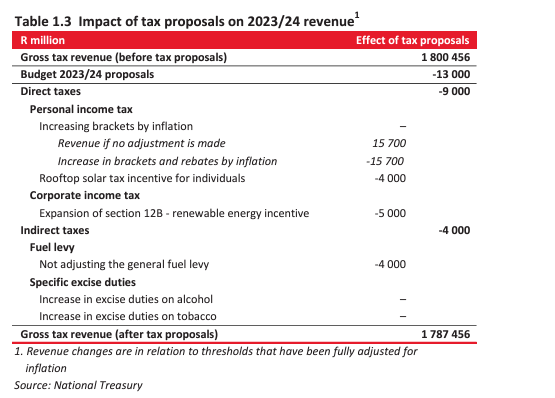

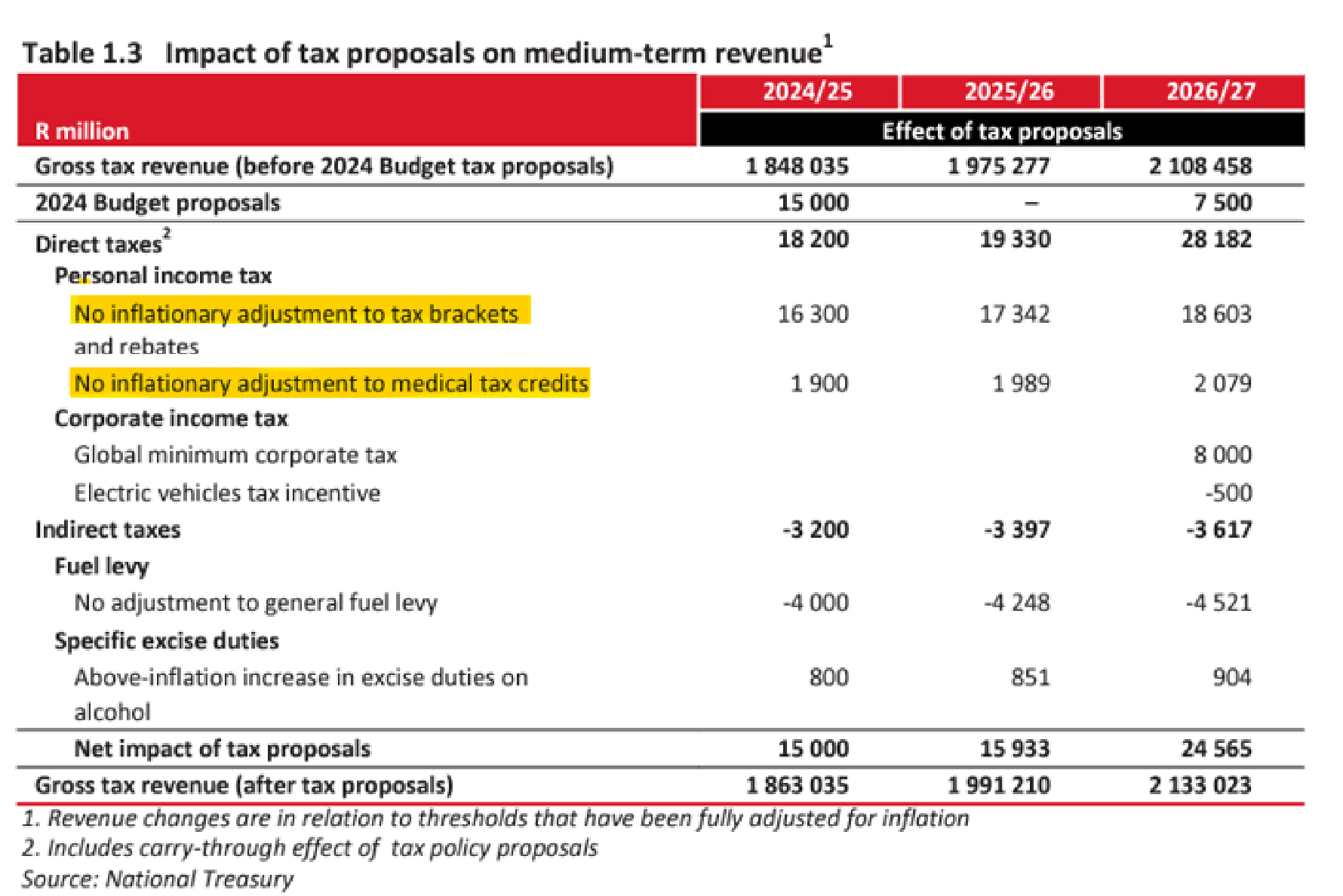

We have however started seeing a challenge developing with misinterpretations. These sometimes make it into mainstream media, often quoting from the specialists coming from household names. An example hereof is of a big tax change that is touted as that flew under the radar. This refers to that tax brackets will be frozen for three years. The upshot is that South Africans will be boosting government’s revenue’s while getting zero relief from the impact of inflation until after the 2027 fiscal year. The Minister is also accused of not mentioning this in his Budget Speech. The Minister did not mention this as there is no such announcement. There is no reference hereon also in the supporting schedules. The only possible reference hereto is from Table 1.3 “Impact of tax proposals on medium term revenue” from National Treasury, but this hardly supports the conclusion drawn –

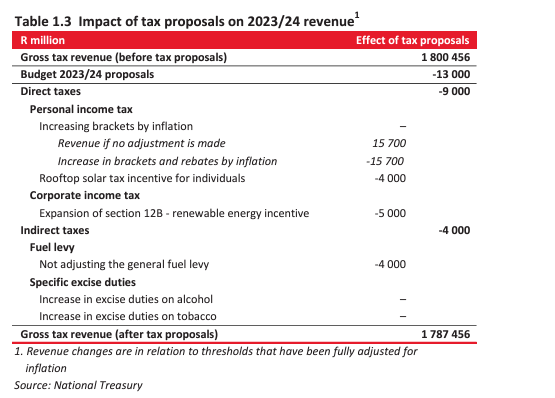

3. Compare against last year

It is useful to compare the table to last year’s budget and it then shows how National Treasury has been trying to be more transparent. Their comment, which is correct, that there is no inflation for tax brackets, simply is with reference to showing the table over three years –

4. Take Home

The budget cycle is always annual and this type of decision is not made three years in advance. National Treasury simply does not have a crystal ball and will not now decide that for 3 years there is no inflation adjustment to tax brackets. One would expect that they will at least give relief each year for the lower income classes and those most vulnerable to the impact of inflation. We must simply accept that South Africa has now fully run out of options and Treasury is bare. Dipping into the gold and forex reserves is putting the hands into the nest egg. We will be unpacking these in more detail in our webinar which is free to attend and part of how we give back to fellow professionals.

![2025-logo-[Recovered] Tax Consulting South Africa](https://www.taxconsulting.co.za/wp-content/uploads/2025/01/2025-logo-Recovered.png)