Mpeluza joins the long list of prominent businesspersons and local celebrities, such as Jimmy Auby, Kagiso Rabada, and MaMkhize, who must now “pay the piper” for years of tax non-compliance, ranging from non-submission of tax returns to non-payment of tax debts due to SARS, or face the repercussions.

How a Tax Debt Arises

A tax debt usually arises out of negligence, however there are instances whereby it is a case of intentional non-payment, or further compliance infringements.

It is important to know primarily, where a tax debt can originate from. The usual culprits here are:

- Administrative penalties on late or non-submission of tax returns;

- Estimated assessments resulting from a failure to submit tax returns;

- The submission of tax returns, without any payment thereon; and

- Partial payment of a tax liability, or unpaid interest and penalties.

Criminality of Non-Compliance

Section 234 of the TAA outlines the acts, and omissions which SARS consider as criminal offences, relating to non-compliance with tax Acts. This section further states that any person who wilfully commits one of the listed acts, or wilfully / negligently fails to act, may be liable, upon conviction, to a fine, or imprisonment of up to 2 years.

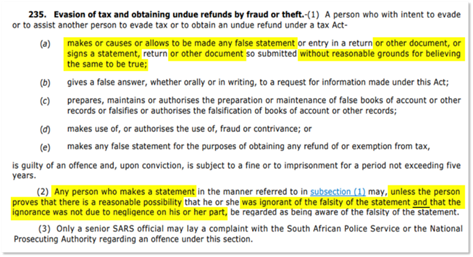

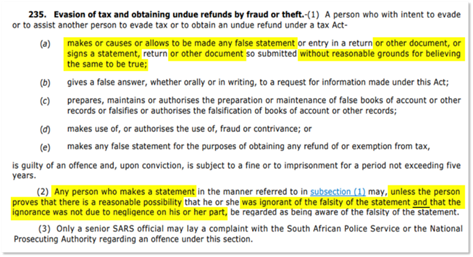

This is only the tip of the iceberg however, as Section 235 of the TAA goes even further, speaking to tax evasion, and obtaining undue refunds through fraud or theft. This comes with a 5-year potential imprisonment:

When you venture into the realm of navigating your complex and high-value SARS Tax Debt, essentially one of the most important decisions you will ever take, the integral starting point is ensuring your chosen representative provides you with legal professional privilege on all sensitive information shared.

SARS’ Hitmen

SARS’ Debt Management Team, in conjunction with either the SARS Asset Forfeiture Team, or Sheriff of the Court, are empowered to initiate a number of collection proceedings against the non-compliant taxpayer, including, but not limited to:

- Collection of outstanding tax debt via Third-Party Appointment i.e., Employer, Bank, or Debtor;

- Issuing of a judgment and credit bureau blacklisting;

- Attachment and auction of taxpayers’ assets;

- Asset repatriation of any offshore interests; and

- Forced Liquidation/Sequestration of the taxpayer’s estate.

Fortunately, a taxpayer can make a Request for Suspension of Payment, with the assistance of a tax attorney, when they have received a Letter of Demand from SARS that they intend to dispute, which automatically suspends the tax liability.

Alternative Avenue for Resolution

It is also important to take cognisance of the tax debt relief measures as contained in the TAA, as where a taxpayer does not have legal merits to pursue an objection but has difficulty in settling their tax debt. In such cases, a Compromise of Tax Debt application (“the Compromise”) is always available to the taxpayer.

The Compromise is aimed at aiding taxpayers to reduce their tax liability by means of a Compromise Agreement (“the Agreement”), which is entered into with SARS. Where SARS is approached correctly, and the taxpayer’s financial circumstances warrant it, a tax debt can be reduced, and the balance paid off in terms of the Compromise.

Next Steps

Where the tax debt owed is in the millions, SARS are often aggressive in collections, and having an attorney with trial advocacy experience under their belt gives you an undisputed edge in negotiating on the legal papers submitted. Beyond this, where the correct legal course of action per the Tax Administration Act is followed, you will not be subjected to funds withdrawn from your bank account, without your consent.

Additionally, section 256(3) of the TAA enables taxpayers who have successfully concluded either a Deferral of Payment or Compromise of Tax Debt agreement to apply for a compliant TCS pin, despite their tax debt.

In the end, total tax compliance is the ultimate goal, be it through the rectification of an error by SARS or securing a settlement which is more affordable in a given instance!

![2025-logo-[Recovered] Tax Consulting South Africa](https://www.taxconsulting.co.za/wp-content/uploads/2025/01/2025-logo-Recovered.png)