Without a TCS PIN approved by SARS cross-border financial transactions can be delayed and potentially damage the taxpayer’s reputation with stakeholders.

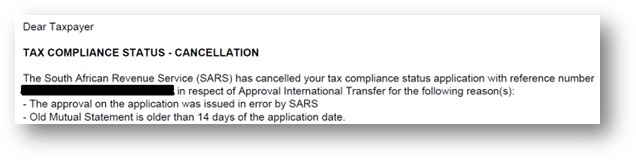

SARS informed the taxpayer the TCS PIN approval was cancelled due to insufficient and outdated documentation. From SARS notice is it clear the taxpayer could have saved himself a headache and time by submitting accurate and timely information to the tax authority for securing and maintaining tax compliance approval.

Failure to meet SARS’ stringent documentation and information standards can lead to application declines and cancellations, even after initial approval, so best ensure SARS does not find you wanting.

Implications of a cancelled TCS PIN

A cancellation can lead to:

- Delays in financial transactions: A cancelled TCS PIN means that the application must be resubmitted, delaying planned transactions.

- Increased administrative burden: Taxpayers must recompile documentation and navigate the reapplication process, which can be time-consuming.

- Potential financial or reputational risks: Delays or non-compliance could have financial consequences or impact the taxpayer’s reputation with stakeholders.

Common reasons why a TCS PIN may be cancelled

- Insufficient or inaccurate documentation

Avoid submitting incomplete or outdated supporting documents as SARS requires all documentation to be current to ensure accurate assessment. For example, in the case of a recent application, the financial statement provided (from Old Mutual) was older than 14 days.

- Approval issued in error

Occasionally, SARS may identify an error in an approval issued, leading to it being revoked. While this may seem unfair, it highlights the importance of ensuring all aspects of the application meet compliance requirements before submission.

- Non-adherence to specific guidelines

Each TCS PIN application type – whether for International Transfer, or other purposes – has unique documentation and procedural requirements. Failing to meet these can result in rejection or cancellation.

How to prevent a TCS PIN cancellation

- Ensure documents are up to date

Financial statements and other required documentation should be no older than 14 days at the time of submission. Regularly update your records to ensure compliance.

- Understand the requirements

Familiarize yourself with the specific requirements for your TCS PIN application type. SARS provides detailed guidelines, and professional advisors can offer additional clarity and guidance.

- Conduct a pre-submission review

Double-check all documentation and information for accuracy and completeness. Address any discrepancies before submission.

- Consult a tax professional

Working with a professional tax consultant or advisor can help ensure your application meets SARS requirements and minimize the chances of rejection or cancellation.

What to do if your TCS PIN is cancelled

If SARS cancels your TCS PIN, carefully review the notice from SARS to identify what went wrong; address any missing or outdated documents and ensure all information is correct; resubmit the application with updated documentation and a clear explanation. If required; engage a professional tax consultant to assist if you are unsure on how to proceed.

Conclusion

While a TCS PIN cancellation can be frustrating, it is often avoidable with proper preparation and attention to detail. Staying informed, maintaining updated records, and seeking professional advice when needed can go a long way in ensuring a smooth application process.

Tax compliance is a shared responsibility. Taking continued proactive measures can save significant time and reduce stress. For more information or assistance with TCS PIN applications, consider reaching out to a trusted tax advisor.

![2025-logo-[Recovered] Tax Consulting South Africa](https://www.taxconsulting.co.za/wp-content/uploads/2025/01/2025-logo-Recovered.png)