Freedom of Movement

When government struggle to meet its revenue estimates and projections fall short in three of its four main tax revenue instruments, proposals to increase the tax base are raised; and in this year’s budget speech, the Minister has looked to a fuel levy increase yet again.

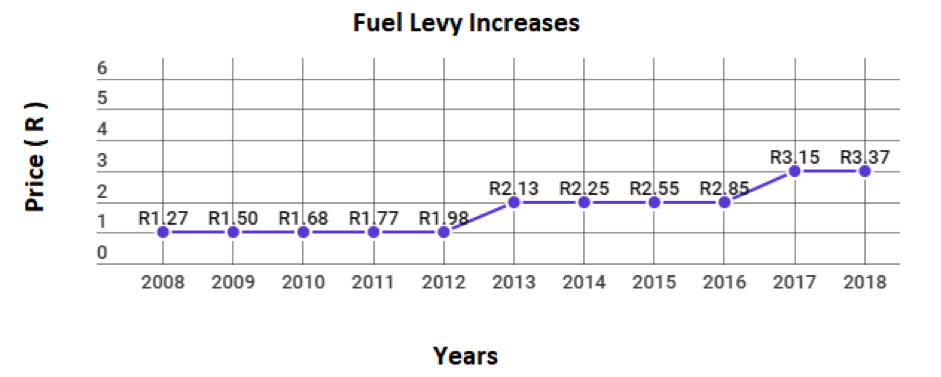

And with increases dating as far back as 2008, yet again, pressure is mounted on taxpayers and on South Africa’s slowed economic growth, to increase tax revenue.

In the 2019 Budget Speech, the Minister mentioned that fuel levy will increase by 29 cents per litre of petrol and 30 cents per litre for diesel. This comes after South African motorist experiencing record high fuel price hikes in 2018. By the look of things, the road to ‘plum-full trees’is rough and riddled with potholes.Additionally, the only recommendation raised to address the ever-rising fuel levy, brought with it a double-whammy of tax. In the 2017 Budget Review, it was proposed to remove fuel from the list of zero-rated VAT supplies, while freezing and/or decreasing the fuel levy – effectively creating a VAT on tax situation.With fuel as one of the main sources of energy, that most sectors in the economy depend on – along the supply chain. The ever-increasing fuel levy will prove to be a hurdle for most of these sectors and the end consumer.

![2025-logo-[Recovered] Tax Consulting South Africa](https://www.taxconsulting.co.za/wp-content/uploads/2025/01/2025-logo-Recovered.png)